Collateral Damage: USD0++ Depeg Leaves Farmers in the Red

DeFi is in shambles after the Usual team changed core parameters without prior dicussion or announcement. Plus we cover the AICC launch and all of the KOL's who dumped hours after its explosive launch

Today we’ve got a full breakdown of the Usual Money changes to their yield bearing USD0++ product that led to several hundred million dollars of capital to be put at risk in DeFi.

Make sure to go and check out our sponsor FX Protocol. They provide unliquidatable leverage for ETH BTC and other crypto up to 10x. Use our ref link: https://fx.aladdin.club/assets/?code=LeviathanN

We also broke down the controversy around AIccelerateDAO’s launch, where many high profile KOL’s including Bankless VC and founder David Hoffman dumped on retail hours, were caught, and then rebought later after being called out.

What Happened?

On January 9, Usual Money introduced changes to its USD0++ protocol, a bond-like financial instrument backed by US Treasury bills. The announcement caused an immediate “depeg”, with USD0++ dropping to as low as $0.89 before stabilizing around $0.92, an 8% drop from its previous $1 peg.

Previously, users could redeem USD0++ at a 1:1 ratio with USD0 (itself backed by USDC).

USD0

USD0 is a stablecoin issued by Usual.money, fully collateralized by real-world assets such as US Treasury bills and USDC. It’s designed to maintain a 1:1 peg to the US dollar.

USD0++

USD0++ is the “staked” version of USD0, operating as a bond-like financial instrument that generates yield for users willing to lock up their assets. By staking USD0, users convert it into USD0++ to earn rewards in the platform’s governance token, USUAL. Unlike USD0, USD0++ comes with a four-year lock-up period.

USUAL

USUAL is the governance and utility token of the Usual.money platform, distributed as rewards to USD0++ holders. The token represents a share of the platform’s revenue, derived from investments in Treasury bills.

How They Work Together

Users acquire USD0 as a stable, dollar-pegged token.

To earn additional returns, they can stake USD0 into USD0++ on the Usual.money platform.

USD0++ holders earn rewards in USUAL tokens, which can be sold or staked for compounding returns.

At the end of the four-year term, USD0++ can be redeemed for USD0 at a 1:1 ratio. Alternatively, users can exit early via the platform’s dual exit mechanisms, subject to penalties.

Usual had sold USD0 and USD0++ on their website for $1. They attracted hundreds of millions of dollars in TVL, which is now locked for 4 years, only to change the rate at which they would redeem USD0.

The update introduced two new exit options:

Conditional Exit: Redeem USD0++ at a 1:1 ratio by forfeiting a portion of accrued rewards.

Unconditional Exit: Redeem USD0++ immediately at a floor price, set at $0.87, which will rise to $1 over the next four years.

This effectively redefined USD0++ from a stablecoin-like instrument into a zero-coupon bond.

Fallout and Market Reactions

The changes triggered panic among users and liquidity providers:

Millions of USD0++ were sold off, causing significant imbalance in its largest Curve Finance pool. Currently the pool is sitting at 8/92%.

Morpho, MEV Capital, & Liquidations

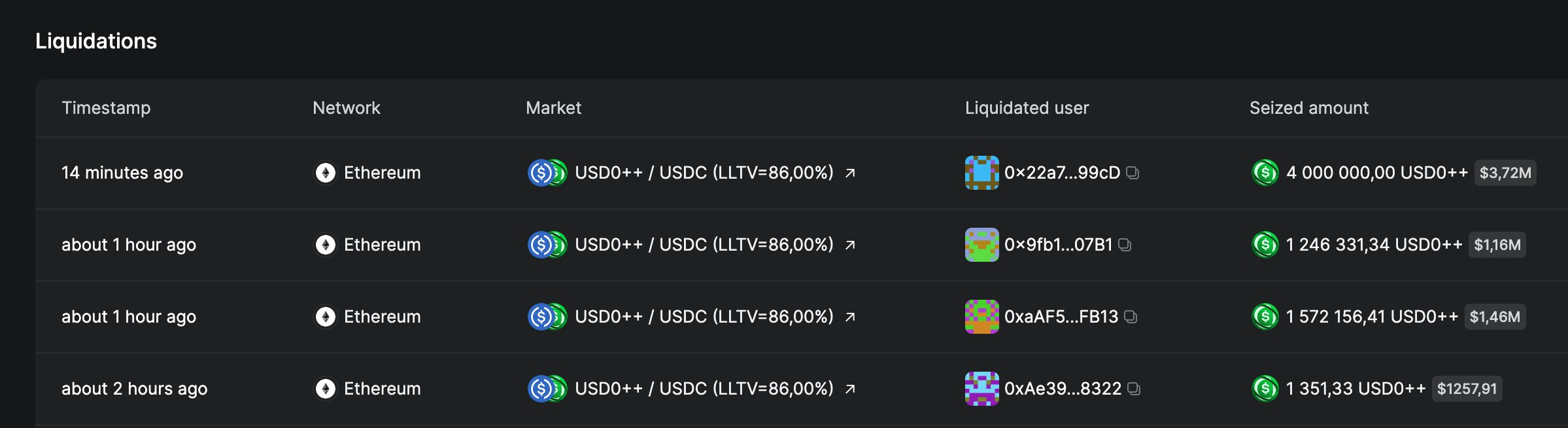

The bulk impact of USD0++'s depeg was particularly acute on Morpho, where borrowers had extensively used the token as collateral to secure loans in USDC and gain massive leverage.

“There's no free lunch. You can price a bond different ways in a lending protocol and the associated interest rate should trade differently depending on how you price it. Lenders ideally should be aware of the risks of different pricing methodologies. Borrowers love fixed price oracles for a variety of reasons and this should mean markets with fixed price oracles have higher borrower demand, and interest rates, than markets with secondary market pricing.” - Michael from Euler Labs

Morpho hosts two primary markets for USD0++: one using a hardcoded oracle that values the token at $1, and another relying on a Chainlink oracle that reflects market prices. When USD0++ dropped to $0.92, borrowers in the Chainlink market faced immediate liquidations as their collateral fell below the 86% Liquidation Loan-to-Value (LLTV) threshold. Meanwhile, the hardcoded market temporarily shielded borrowers by maintaining the $1 valuation, though this created systemic risk by misrepresenting the asset’s true market value.

“Here is why harcoding to a pricefeed and making it immutable can cause devastating issues. I am not saying its should never be the case, but this particular use-case it definitely wasn’t good idea because of the price deviation between the illiquid price discount vs value at maturity - Stani Kulechov, Founder of Aave

It’s interesting to see which actor’s were affected by the depeg. In the Chainlink-enabled market, borrowers paid the price and were liquidated into thin liquidity. However, with the hardcoded market, lenders suffered, as the pool was not pricing correctly. When the repricing occurred, all liquidity was sucked out, utilization skyrocketed, and borrow rates increased to triple digits.

No major liquidations occurred on the hardcoded oracle, the largest was for $500. MEV Capital, the largest lender into the pool, moved their liquidity to the new “naked” pool. Borrowers were able to zap their positions into the new pool to escape the high interest rates.

Usual Money actively facilitated liquidations to prevent bad debt in the wake of the USD0++ depeg.

Liquidations in USD0++ markets were unprofitable because the asset’s market rate fell below thresholds of $0.975 for PT markets and $0.955 for the main USD0++ hardcoded market.

To bypass this limitation, the Usual team leveraged their ability to redeem USD0++ at $1 without any redemption price controls, ensuring profitability in the process.

In a funny twist, liquidated users benefited compared to unwinding their positions, effectively "selling" their USD0++ collateral to the team at a premium of $0.95-97 relative to the $0.925 market rate.

However, the team did not synchronize these liquidations with MEV Capital’s market withdrawals, creating opportunities for arbitrage. Some participants exploited this by purchasing USD0++ at $0.925, cycling it through Pendle transactions, and effectively "selling" it to the liquidation process at $0.975, with the expectation the Usual team would maintain the liquidation strategy.

Meanwhile, others bypassed MEV Capital vault entirely, directly lending at APYs exceeding 100%, expecting Usual Money to step in and prevent any bad debt, which they eventually did.

Another concerning fact about Usual is the relationship between Adli TAKKAL BATAILLE, the founder of Usual Money, and MEV Capital, which has raised concerns about potential conflicts of interest. He is a co-founder of Shift Capital, an investor in MEV Capital.

MEV Capital suffered losses, and was not informed before other market participants.

Pendle PTs Rekt

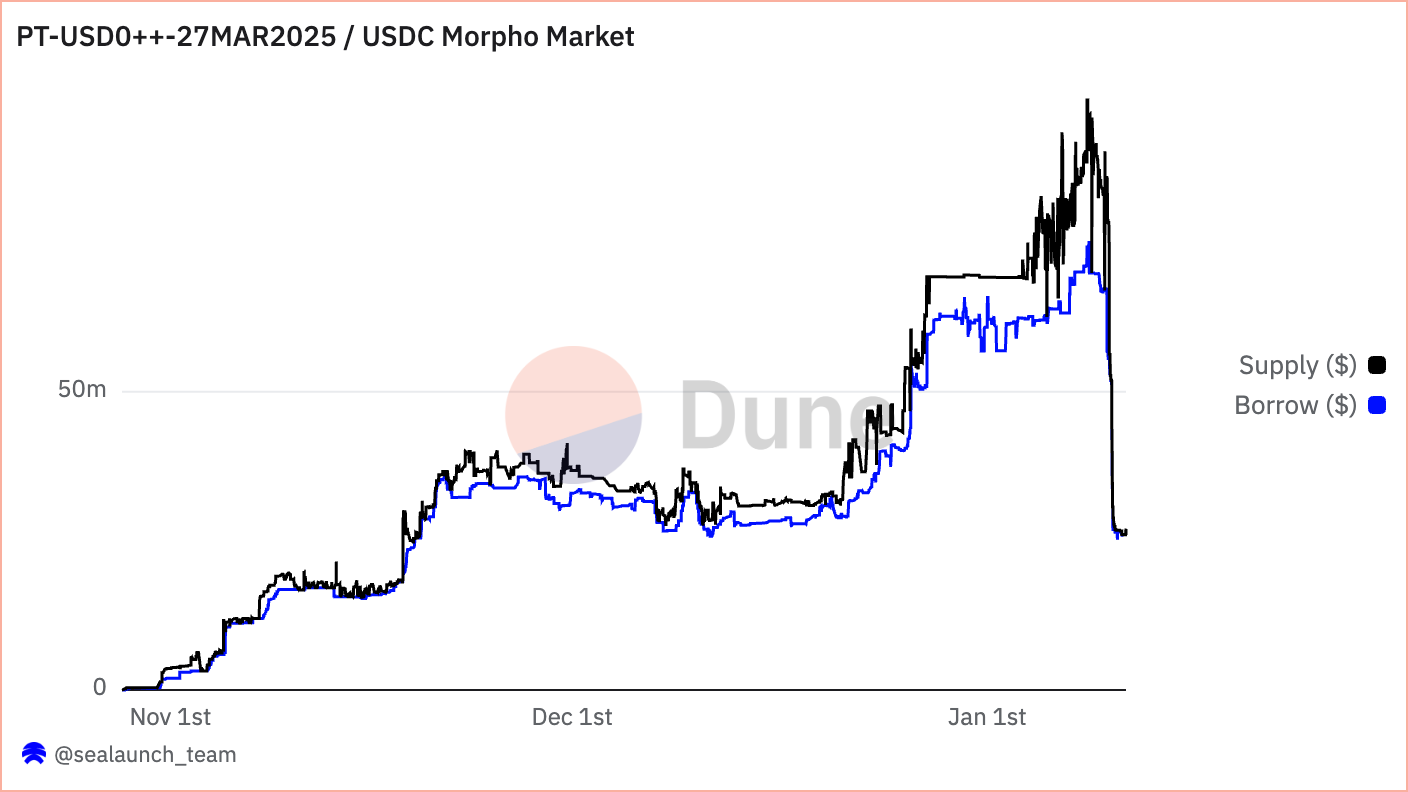

One third of Usual’s TVL sat in Pendle, where PT buyers suffered substantial loses after the repricing.

The sudden depegging of USD0++ and its reclassification as a bond-like instrument also caused significant disruption for users of Pendle PT (Principal Token) markets. PT buyers by the future implied value of USD0++ at a future expiration date. With the price decline, any gained yield would be offset.

With USD0++ revalued to a $0.87 redemption floor, the pricing assumptions underlying Pendle PTs were thrown into disarray, leading to steep discounts and massive liquidations in the Morpho lending pool. In just a few hours TVL declined by half to $25m.

USDC Lenders and MEV Capital Vault

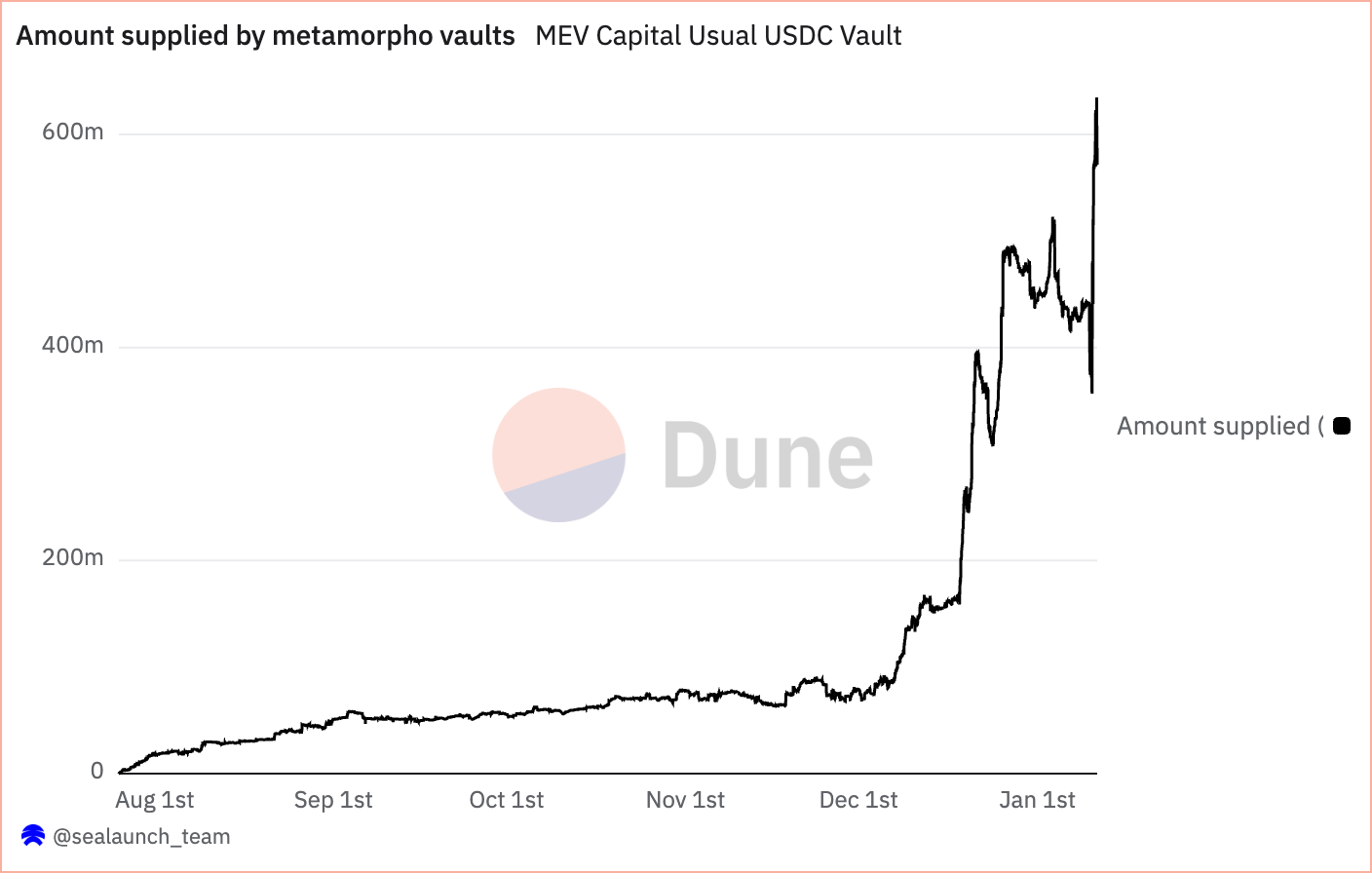

The aftermath of Usual Money’s abrupt redemption changes to USD0++ had significant ramifications for the lending markets on Morpho, with MEV Capital at the center of the response.

MEV Capital’s USDC vault on Morpho saw massive inflows, growing to $600 million in 24 hours, as lenders were drawn by the high APRs resulting from skyrocketing borrowing rates.

However, this surge in liquidity coincided with increasing systemic risk, as the depegging of USD0++ to a new redemption floor of $0.87 exposed vulnerabilities in collateral valuations and market stability.

Thankfully, MEV Capital was able to prevent bad debt to the pool by deploying several new markets on Morpho, including a "naked floor price" market pegging USD0++ to its $0.87 redemption value and Chainlink-powered markets reflecting its true market price. These new markets, with Loan-to-Value (LLTV) ratios as high as 96.5%, were designed to help borrowers refinance and reduce borrowing costs, but they also represent a significant shift in risk management strategy.

MEV Capital’s handling of the situation raises questions about its preparedness and decision-making. Despite benefiting from high lender participation during the crisis, the vault’s reliance on hardcoded oracle markets exposed it to systemic risks that could have led to bad debt had USD0++ dropped further.

Additionally, MEV Capital disclosed that it received no prior communication from Usual Money about the redemption changes, casting doubt on the transparency of the coordination between key players.

Was This Predictable?

Yes and No.

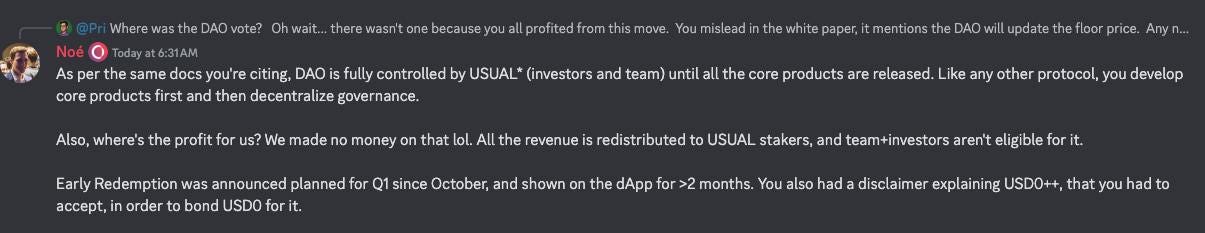

The changes made to the redemption price were executed solely by management. There is no Usual “DAO” that has control over parameter changes and other governance decisions. The Usual team has full control over the multi-sigs and their unannounced, non-telegraphed unilateral decision severely affected markets.

Contrast this with Aave, which needs a temp check forum post, temp check snapshot, ARFC forum post, ARFC snapshot, AIP on-chain vote before any onchain changes occur. This allows market participants to adjust their positions/exposure/risk well ahead of any parameter changes.

If Usual had actually had a “DAO” with discussion, governance and voting, this situation never would have arisen. It’s situations like these that the SEC and other agencies love to point at to show the faux nature of “decentralization” claimed by teams about their products.

USD0 pricing is what the team sets the redemption floor at, so in this case, it clearly would meet the Howey prong that this an investment with “a reasonable expectation of profits to be derived from the efforts of others.”

The Usual team sold a bond-like structure for months with a 1:1 redemption rate, only to change it unannounced when they had achieved enough TVL. Conveniently, anyone who now is 8% down of their investment, can immediately unlock the full value of their USD0++ by burning 10% of their position’s value in USUAL tokens.

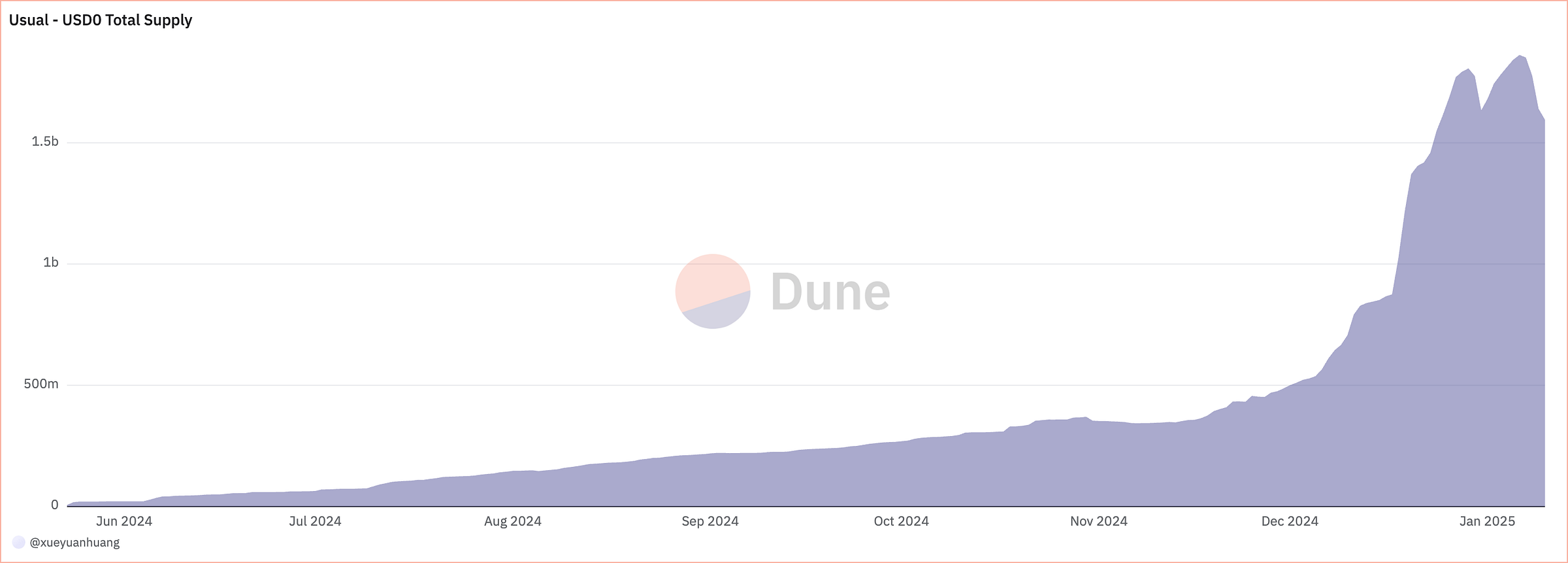

More conveniently, the redemption price changes come only after USD0’s total supply had peaked in December of this year. USD0++ was sold and redeemed at 1:$1 only during their hypergrowth period.

Now, with $1.53 bn USD0 locked into their protocol for four years, any major changes are borne solely by market participants.

Usual achieved their mission of bootstrapping their protocol, but now, at what cost have they damaged support for the protocol long-term? Affected parties who are now sitting on losses might sell and never return to the project.

Here’s the issue with Usual. Insiders, funds, and other sophisticated market participants probably guessed correctly that USD0++ would trade below $1 at some point in the future. It’s designed to be a zero-coupon bond, with interest paid in USUAL. You don’t have to be a bond nerd to price it at fair value.

The team knew for months they would change the redemption mechanism in Q1, yet they marketed heavily to retail users that USD0++ was sold 1:$1 and could be redeemed for $1 before the change. They sat by while MEV Capital created a Morpho lending pool hardcoded to $1, and then allowed it to grow to hundreds of millions of dollars in size before unilaterally changing market pricing. Additionally, they also let Pendle’s PT markets grow similar in size and watched as millions were liquidated.

Usual’s decisions are either gross incompetence or malicious intent, and it's retail who eats a massive shit sandwich while the team now has $60m+ revenue for the next 4 years. USD0++ will trend towards $1 over the next couple of years or even months. However, uninformed farmers who thought they were buying a 1:1 asset are now locked into unexpected circumstances. Some affected investors are already planning litigation against Usual for their actions.

The warning signs about the repricing were there for anyone to see. Post-hoc, the team is stating in Discord that the redemption changes were long-telegraphed and should not be a surprise to anyone who read the docs.

Damage is done at this point however, the total number of USD0++ holders is down nearly 25% at this point. It’s going to take some time to recast their narrative and build trust again. A proper DAO with voting, discussion, and onchain governance is a must. Only then might we see a return to normality for Usual.

Bankless Ventures, ai16z Caught in AICC Token Scandal

Down the timeline, Aiccelerate DAO — a self-described initiative to integrate cryptocurrency and AI — went from market darling to being a controversial hot pot. Aiccelerate brands itself as a DAO focused on both investment and innovation in "AI Agent" technology, aiming to build a collaborative developer network to advance its goals. Its high-profile advisory team include figures such as Shaw, founder of ai16z; Nader Dabit, director of developer relations at EigenLayer; and Andrew Kang of Mechanism Capital.

After its launch on January 11th, the token’s value shot up from its fundraising price of $175,000 to a market cap exceeding $400 million, only to crash by over 80% within hours. The rapid sell-off drew attention.

Andy of therollopco pointed out that Bankless Ventures secured multiple large allocations, which were worth millions at the time but had failed to add any real value to the project. With Bankless promoting AICC and its key figures—like Ejaaz—Andy questions the legitimacy of their actions. Did they earn their $1.7 million or just exploit their audience? Bankless’ role seems more about hyping up the project for personal profit than actually contributing to the DAO's long-term vision.

In the middle of all this, the situation escalated as @0x_ultra created a dashboard to track token sales from influencers. The dashboard soon revealed that Bankless and others were actively dumping their AICC tokens, including Shaw from ai16z, who reportedly sold 96% of his allocation for 400 SOL. The wallet activities showed clear dumping right after launch and raised questions about the project's fairness.

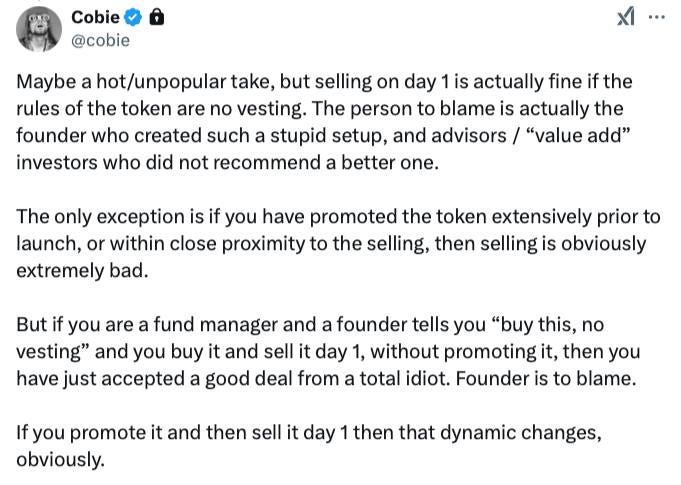

According to the data, the top five addresses profited over $1.31 million from a combined investment of just 4.5 SOL. A 7,907% return on investment! This was a massively flawed token distribution. There was no vesting for advisors and early backers. It's no surprise, then, that the structure incentivized short-term gains over long-term commitment.

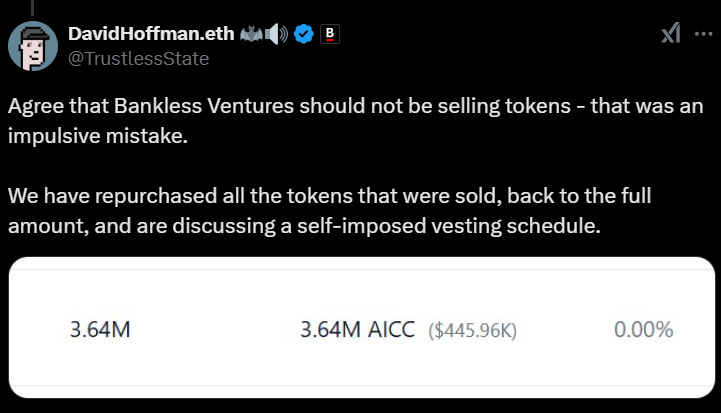

Following the backlash, co-founders David Hoffman and Ryan Sean Adams acknowledged the mistake, repurchased the sold tokens, and proposed a self-imposed vesting schedule. Later, David clarified that Bankless Ventures, led by GP Ben Lakoff, made the decision without consulting him or Ryan. Both co-founders emphasized they never sold their shares and condemned the sale.

Shaw, the founder of ai16z, also found himself at the centre of the AICC controversy. Initially, he praised the project for turning 5 SOL into $2 million but soon faced backlash from the ai16z DAO community. In a now-deleted post, Shaw lashed out, calling AICC a “vampire attack” and blaming its whitelist mechanism for disenfranchising many. He denounced the toxic meme coin culture, labelling critics as “cancel culture babies,” and vowed to focus on AI and “real builders” going forward. The episode has left Shaw reeling—his reputation dented and his trust in the community shaken.

Some advisors, like Jason Zhao of Story Protocol, chose to reinvest their profits. He pledged to donate his entire AICC allocation, worth around $1.78 million, to support open-source AI projects. Looking at it now, it aligns with Story's vision for a universal AI IP system. The donations will be made based on project milestones, with full transparency in the process, and all tokens allocated for research purposes.

Tachi, the founder of Playgrounds and the team behind Arc (AI Rig Complex), moved 100% of their AICC allocation to the Arc Treasury. Of the total, 30% will be used to create AICC/ARC liquidity pairs, to generate fees that will fund ecosystem initiatives and incentivize developer contributions. The remaining 70% has been locked in a custody contract, with linear redemption set for next year.

In response, Aiccelerate DAO has also announced measures to rebuild trust. The team committed to implementing vesting schedules for all allocations, accelerating the development of its first AI agent, and ensuring transparency regarding treasury funds. They also moved DAO funds to secure wallets, emphasizing that no tokens had been sold or misused.

We will leave you with Cobie who is the voice of reason as usual…

Do Kwon Faces Justice in the U.S.

Do Hyeong Kwon, co-founder and ex-CEO of Terraform Labs, has been extradited from Montenegro to the U.S. to face federal fraud charges. Prosecutors allege that Kwon, 33, engaged in schemes to inflate Terraform’s cryptocurrency values through misrepresentations and market manipulation, leading to over $40 billion in investor losses.

Kwon appeared in Manhattan federal court on Dec. 31, 2024. U.S. authorities claim he misled investors about the stability of Terraform's stablecoin (UST) and blockchain protocols. Allegations include misappropriation of funds from the Luna Foundation Guard, market manipulation through automated trading bots, and fabricating claims of real-world use cases for Terraform’s technology, such as partnerships with the Chai payment platform.

After UST and LUNA crashed in May 2022, Kwon allegedly laundered proceeds via blockchain transactions, exchanges, and a Swiss bank account. He was arrested in Montenegro in March 2023 for using a fraudulent passport.

If convicted on all charges—commodities and securities fraud, wire fraud, conspiracy, and money laundering—Kwon faces up to 130 years in prison. The FBI and international agencies collaborated on the investigation and extradition.

Other news

How to Profit on Usual with a delta neutral yield strategy earning 150%

Keep reading with a 7-day free trial

Subscribe to Leviathan News - The Tentacle to keep reading this post and get 7 days of free access to the full post archives.