Liquity v2 Will Be the Biggest DeFi Launch of 2024

Thanks for reading The Tentacle by Leviathan News, we’re the best open-source news community in DeFi and you can get our stories, analysis and trade ideas everyday to your inbox when you subscribe.

News & Noteworthy

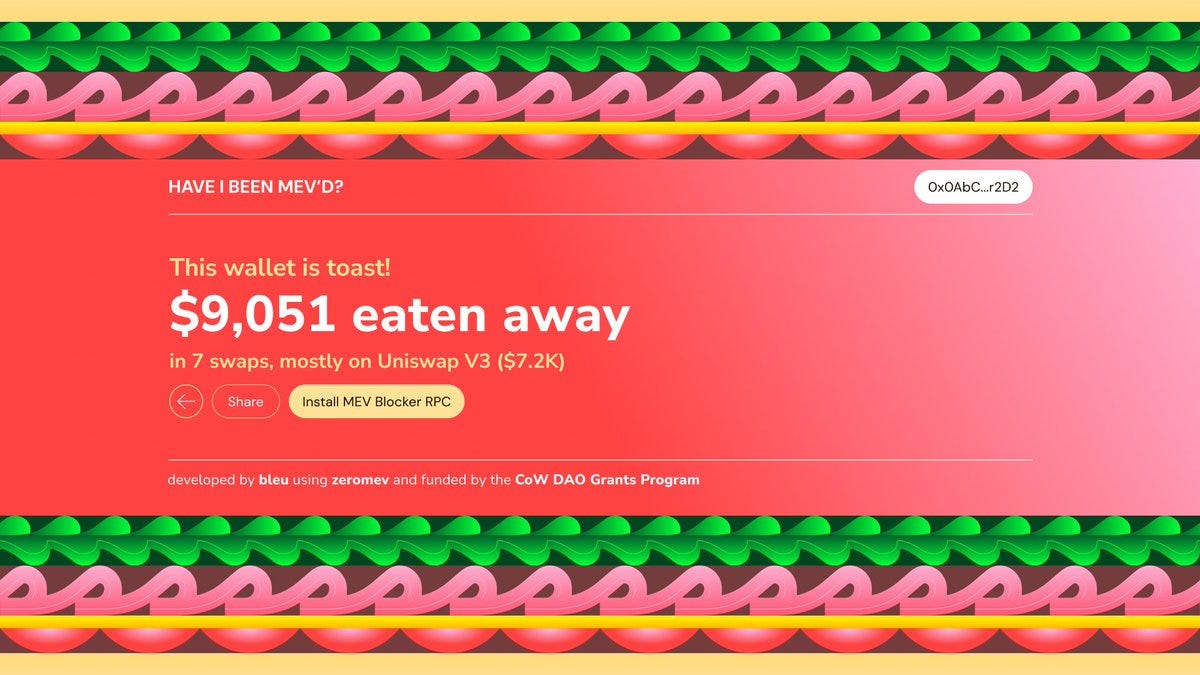

See how much you’ve lost to MEV bots

Yesterday blue from the CowSwap team posted a fun little website that allows you to see how much any wallet has lost to MEV sandwich bots. The app is also built out for Telegram and Discord, so you can see how much money your friends lost and and them endlessly berate them for it.

The neat little tool goal is to get you to start using the MEV Blocker RPC provided by CoW DAO.

Traders lose over a billion dollars a year to MEV, and the EU is trying to figure out if it’s illegal or not. Thankfully if you just switch your RPC out or use DeFiLlama or Rabby swap, you’ll ensure you don’t get poor pricing.

Other News

Biden is trying to win back crypto voters, but its too late we know their game

Galxe is launching their own L1 in June using Arbitrum Nitro

Reads

Liquity v2 is coming… are you ready?

If you haven’t watched one of our many, many, many interviews with Colin Platt and the Liquity team this past year, they are on the brink of deploying what could be the greatest improvement for on-chain lending since the start of DeFi Summer.

While lending TVLs are hitting yearly highs for protocols like Aave, and competitors like Curve with Llamalend and Silo are building key infrastructure for their protocol stack, and with Maker planning on deprecating DAI for their NewStable with inbuilt freeze functions, there is a clear gap in the market for permissionless lending and issuance of a dollarized dollar denominated stablecoin against ETH, LSDs, and LRTs.

The slowing of the permissionless design space is a direct result of rising interest rates over the last year. Almost every protocol shifted their products away from native on-chain yield generation towards TradFi investment assets as onchain yields were in the gutter prompting outflows of stables to less risky, high yielding treasuries.

Now that the market is normalizing and on-chain demand has returned, we’re slowing starting to see a reemergence of truly permissionless DeFi and stablecoins deployed into the market. And the King of decentralized stablecoins is slated to return later this year with the deployment of Liquity v2.

Keep reading with a 7-day free trial

Subscribe to Leviathan News - The Tentacle to keep reading this post and get 7 days of free access to the full post archives.