Trump’s Crypto Playbook: Memes, Millions, and Mayhem Before the Oval Office

In a final act as a private citizen, Donald Trump launched a memecoin, raised $5 billion for World Liberty Financial, and set the stage for crypto chaos that blurred the lines between political power

Could this weekend have been crazier? The last time a single person threw the crypto markets into chaos, we nuked 80% and he went to jail for 25 years. With our memories of SBF fading, crime is now legal again as everyone in the Trump family launches their own memecoin and accepts money from Chinese nationals. Send it.

WE'RE GONNA WIN SO MUCH YOU MAY EVEN GET TIRED OF WINNING AND YOU'LL SAY PLEASE PLEASE IT'S TOO MUCH WINNING WE CAN'T TAKE IT ANYMORE MR PRESIDENT ITS TOO MUCH AND ILL SAY NO IT ISN'T WE HAVE TO KEEP WINNING WE HAVE TO WIN MORE.

If you want to win like TRUMP did this weekend, go use FX Protocol to get unliquidatable leverage on all of your favorite crypto. Use our ref link: https://fx.aladdin.club/assets/?code=LeviathanN

As all eyes were on the Innaugural crypto ball in Washington D.C. on Friday night, President-elect Donald J. Trump played his Joker in a last moment before entering office….

He launched a meme coin. With his fist raised, an assassin-pierced ear on display, and the words “FIGHT, FIGHT, FIGHT” emblazoned like a championship boxing match poster, Trump looks fierce in the X post.

TRUMP launched at 21:01 at a fully diluted market cap of $200m. The market probably thought that it was a scam or a non-official memecoin. However, the second buy order was for $1m by a freshly funded wallet and the third buy was for $500,000 in another freshly funded wallet.

The first wallet sent their $TRUMP to ff.SOL and profited more than $32m just a few hours later. We tried to figure out what was happening with the second wallet which bought TRUMP, but Solana’s block explorer is so shit and hard to understand that it's no wonder that the members, grifters, and criminals love the chain, its im-fucking-possible to retrace without a PhD in hieroglyphics.

Our guess is that insiders knew about the launch and used the first $45 minutes to purchase at size without too many issues. Based on the volume metrics, the market started to sniff out the token was legit after 30 minutes, and then leading up to the X announcement, large buys started taking out ill-informed degens.

After the X announcement, the price immediately doubled from $1 to $2, and it was off to the races from there. The chart went up-only for the next day and a half as the market learned the token was actually official, was legit promoted by TRUMP, and had sucked all the air out of the room… more on this later.

The chart above is beyond wild. It’s the full chart from inception and you can see how short a time frame we shared above of the first four hours. TRUMP ran up from $0.2 to $15, then from $12 to $25, and finally from 17 to $70.

Hyperliquid outcompetes Binance

Hyperliquid was the first perpetual dex to list TRUMP, beating out every other exchange, including Binance. It pushed their market dominance in DeFi to 60% and new ATH’s in volume as well. Hats off to the team for their lightning-fast execution, listing Trump only 3.5 hours after launch. It’s yet another signal of HL’s ear-to-the-ground operational capacity and nimbleness.

We’re in a new era of decentralized dex listings, with CEX listing downstream primarily for perps and spot leverage. Dex listings are “free,” and even corresponding ETH/SOL/USDC liquidity is optional if you start the CL-AMM pool one-sided. With majors like Binance demanding a portion of token supply, funds for market making, and ongoing fees, listing on a dex is the value+ option and will be the go-to deployment method for new tokens in the future. If an EVM/SVM token launches and its primary marketing strategy is to get listed on a T1/2 major exchange… run for the hills.

Liquid for me, but not for thee

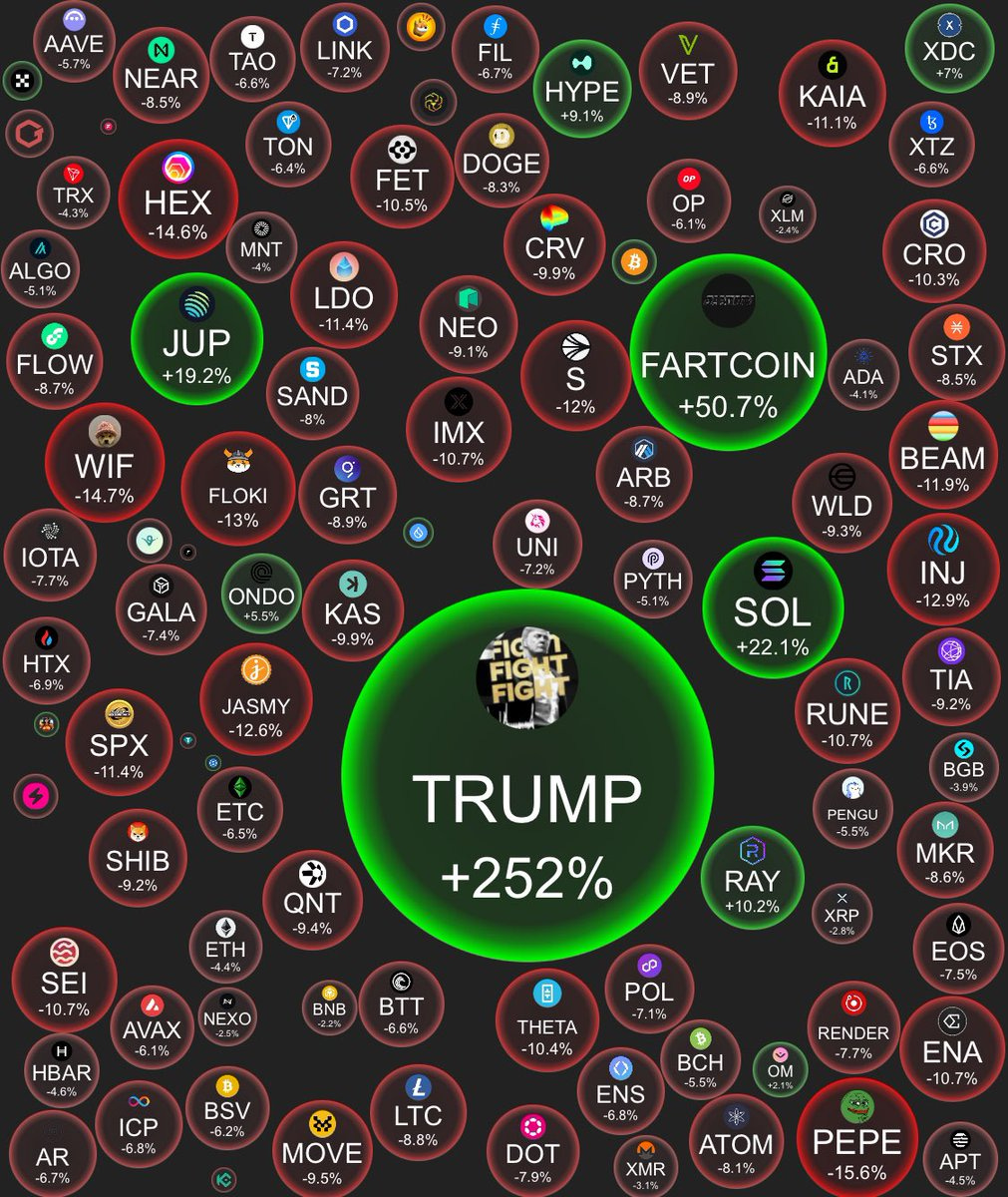

As TRUMP made millionaires in hours, it swiftly drained liquidity from the market, leaving traders grappling with its aftermath. As the hype surged, fueled by endorsements from Trump’s X and Truth Social accounts, trading volumes reached billions.

This shift led to a decline in the prices of several major cryptocurrencies. For instance, Ethereum (ETH) experienced a decrease, with its price currently at $3,339.90, down from an intraday high of $3,452.70. Solana's (SOL) price increased by 25% to $276 to gain exposure to TRUMP on the network.

Trump’s crypto history

It’s wild to think how far the Overton window has shifted with Trump’s final days before taking the presidency. The most powerful man in the world entered the trenches, which had only been terrorized a few months ago by former SEC Chair Gary Gensler, Liz Warren, and a bevy of other alphabet-soup agencies in the US and globally.

Any barriers to private citizens, corporations, or other entities launching their own crypto token are now practically removed.

Trump sells branded NFTs

Trump started his crypto journey back in December 2022, with his NFT collection “Trump Digital Trading Cards,” featuring 45,000 unique collectibles minted on the Polygon blockchain.

The collection depicted Trump in various outlandish and heroic scenarios, from a cowboy to an astronaut, embracing a blend of campy Americana and meme-worthy absurdity.

The NFT’s were sold at $99 each at the time and also had other sweepstake prizes such as dinner with Trump, golf outings at his properties, and signed memorabilia. The collection sold out in 24 hours, raising $4.5m for Trump in primary sales.

At the time, Trump was lambasted for selling NFTs. We were on the wrong side of the NFT bubble and many mocked the artwork and Trump’s interest in crypto.

Trump launched 4 NFT collections, with Season 2 driving the most volume during this current narrative.

Shkreli’s DJT launch + RTR

The next supposed Trump-affiliated project was a failed memecoin called DJT, which has one of the most bizarre stories of 2024 and deserves a long-form investigation in the future.

Back in August, someone launched the ticker DJT, coincidentally the same symbol as Donald Trump’s Truth Social stock. Within 24 hours, its value surged by 385%, hitting a trading volume of $363 million.

The sudden rise in interest, coupled with rumors of Trump family involvement, prompted Arkham Intelligence to offer a $150,000 bounty to identify the creators.

Blockchain sleuth ZachXBT revealed that DJT was created by Martin Shkreli, who is infamous for his pharmaceutical price-gouging scandal.

Shkreli later confirmed his involvement in a live Twitter Space, claiming that Barron Trump, the 18-year-old son of Donald Trump, was the “mastermind” behind the coin. According to Shkreli, Barron was approached by a friend to collaborate on the project, which supposedly had the former president's approval.

While Shkreli denied that the token was tied to campaign fundraising, he claimed the funds were intended solely for Barron. Despite his assertions, no definitive proof of Barron’s involvement has been presented, and the Trump family has not commented on the situation, leaving the token’s true origins and purpose shrouded in mystery.

Subsequently, Eric Jr. and Don supposedly launched Restore the Republic with Icebagz but quickly came out and denied any connection to the token.

“Barron Trump’s” Pump.fun Foray

In a bizarre yet fascinating twist of on-chain activity, a wallet loosely connected to Barron Trump was reported to have deployed a memecoin $BARRON, on Pump.fun this weekend. The Trump family gave no official confirmation.

However, at 8:09 EST on Saturday, January 19, Martin Shkreli commented on the matter, stating, “looks right to me but I have to go check my file at home to get the exact thing. seems like his sense of humor. funny kid.” $BARRON graduated from pump.fun 8 minutes later at 8:17.

CT took the comments to be quasi-official, and ran the token. In the next hour BARRON ran up to $123m market cap and then proceeded to decline by 90%.

After 4 hours of consolidation, BARRON ran up again, this time to $440m market cap on millions of dollars in volume. Once again the token sold off, declining by 95% again to $30m overnight while US traders slept.

The connection to BARRON was through Martin Shkreli, who initially minted $DJT and transferred the supply to Barron’s wallet, which was confirmed during a Twitter Spaces discussion on the launch. Subsequent transactions revealed Barron moved 1.1M SOL (~$1.1M) to another wallet and, from there, to a separate deployer wallet used to launch BARRON.

While it remains unclear whether Barron actively participated or if this is an elaborate stunt by Shkreli to rug some shitcoins, we’re reaching a point in the market where degens who missed the first TRUMP pump are foaming at the mouth for a repeat. If history is to guide us, the thousands of copycat derivative coins are simply grifts of a higher order run by non-affiliated teams preying on unsuspecting retail. Stay safe in those trenches Squids.

Justin Sun Apes Into World Liberty Fi: Foreign Influence or Strategic Gambit?

World Liberty Financial (WLFI) wrapped up its raise at a staggering $5 billion valuation (bigger than Aave’s market cap…lol), cementing its place as a flagship DeFi project backed by the Trump brand.

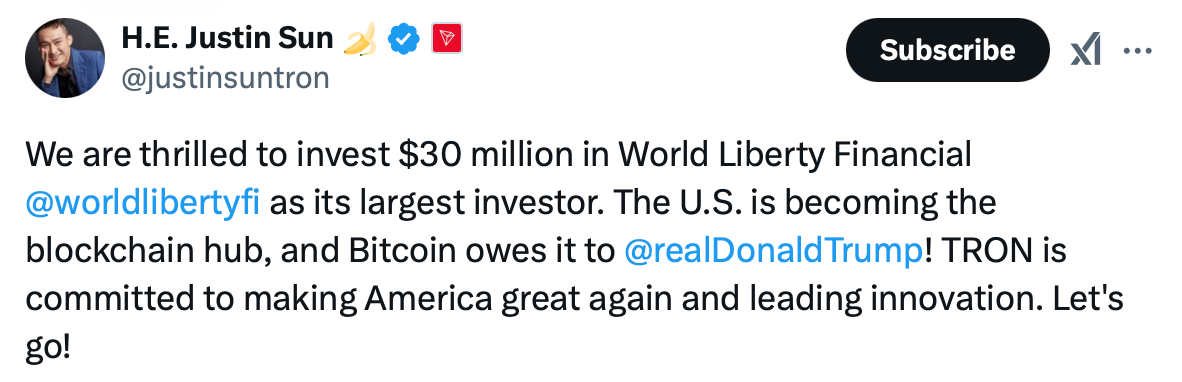

Yet, the real fireworks came with Justin Sun’s unexpected $30 million investment just 24 hours before Donald J. Trump officially took office. Sun, a Chinese national and founder of TRON, has long been a polarizing figure in crypto, but his involvement in a Trump-affiliated project raises questions that extend far beyond the blockchain.

For the past four years, U.S. politics have been consumed by allegations of foreign influence, with Joe Biden defending his son Hunter against accusations of peddling access to power.

Now, as Trump prepares to step into the Oval Office, Justin Sun’s multimillion-dollar investment risks reigniting the same controversies. The optics of a high-profile Chinese entrepreneur funneling funds into a Trump-endorsed project are, to put it mildly, awkward—especially given Trump’s past rhetoric about being tough on China.

Adding another layer of intrigue, Sun is currently under Federal investigation and embroiled in a lawsuit with the SEC over alleged violations involving unregistered securities offerings. His investment in WLFI could be interpreted as a strategic move to curry favor with the incoming administration, potentially shielding him from further legal scrutiny.

On his final day as a private citizen, Donald Trump delivered a masterclass in narrative and financial showmanship, launching a series of crypto ventures that cemented his influence in the blockchain world. From the TRUMP memecoin frenzy to the $5 billion raise for World Liberty Financial (WLFI) and even the bizarre Barron Trump-related $BARRON token, Trump weaponized his celebrity status and his family’s involvement to dominate headlines and liquidity pools. By acting just hours before taking the oath of office, Trump avoided running afoul of the Emoluments Clause, a constitutional safeguard preventing presidents from profiting from foreign entities or enterprises during their term. These last-minute maneuvers ensured his family’s financial stake in WLFI, a DeFi project with governance tokens promising no economic rights, yet commanding overwhelming demand in its public sale.

Adding to the drama, Barron Trump’s alleged connection to $BARRON and Martin Shkreli’s cryptic claims only fueled speculation about the Trump family’s immersion in the memecoin trenches. Meanwhile, Justin Sun’s $30 million investment in WLFI on the eve of Trump’s presidency further complicated the narrative, raising concerns about foreign influence at the intersection of crypto and politics. The timing couldn’t be more pointed: Sun, a Chinese national with a history of regulatory scrutiny, seemed to make a calculated move, potentially to curry favor with the incoming administration.

By the time Trump raised his fist at the Crypto Ball and launched TRUMP memecoin to a $24 billion valuation, the world had witnessed an unprecedented overlap of digital assets, political power, and the art of spectacle. Whether through WLFI’s stablecoin dominance agenda or the memecoin chaos that left traders grappling with liquidity voids, Trump’s final hours as a private citizen redefined the boundaries of crypto and politics. In this whirlwind of tokens, regulations, and intrigue, the line between public service and private enrichment has never been blurrier—or more fascinating.

The Final Maneuver: Trump’s Last Day as a Private Citizen

Donald Trump’s plunge into the crypto trenches wasn’t just a spectacle—it was a carefully timed play to sidestep the restrictions of the Emoluments Clause.

By launching World Liberty Financial (WLFI), the TRUMP/MELANIA memecoins, and setting the stage for Barron’s bizarre $BARRON token on his final day as a private citizen, Trump ensured that his family’s financial stakes were secured before taking the oath of office.

The Emoluments Clause, which bars presidents from profiting from foreign or domestic entities during their term, would have prevented him from capitalizing on these ventures had they launched a day later. Instead, Trump’s timing allows him and his family to benefit from WLFI’s $5 billion valuation and TRUMP/MELANIA’s meme coin frenzy —all without crossing legal boundaries.

In just one day, Trump redefined the boundaries of public and private influence in crypto, blurring the lines between personal profit and political power.

You’re going to read a lot of hot takes in the next few days about Trump’s motivations, the morality of the grift, the nihilistic nature of crypto and how it can’t escape simply being a casino. Our knowledge of Trump’s actions is limited, and narratives shift rapidly in environments such as these. Trade the markets, but reserve moral judgment until after the dust settles and Trump’s crypto follies are displayed in full detail.

As his presidency begins, the aftermath of his final hours as a private citizen will undoubtedly leave a long and controversial trail in both crypto markets and the political arena. Whether this gambit signals a new era of innovation or a minefield of conflicts remains to be seen, but one thing is certain: Trump’s final act as a private citizen was nothing short of quintessentially Trumpian.

Join Leviathan News Premium

Keep reading with a 7-day free trial

Subscribe to Leviathan News - The Tentacle to keep reading this post and get 7 days of free access to the full post archives.