Understanding Heroglyphs: "A 60 IQ Protocol with 120 IQ Ramifications"

Today’s post is free for all The Tentacle subscribers. If you like this post subscribe for more crypto and DeFi content since you inbox Monday through Friday.

Heroglphys are what you get when you mix solo staking, memecoins, new age merge mining and Degen culture together to tackle the growing worries of staking centralization caused by LRTs and LSDs. Founder 0xMaki calls it “a 60 IQ protocol with 120 IQ ramifications.”

Heroglyphs Helpful Links

Heroglyphs website: https://heroglyphs.com/

Ken’s Heroglyphs Player’s Handbook (Amazing living resource. Thanks for putting this together.)

White paper unclassified. (There also was a “classified whitepaper” but its older.)

Dune Dashboards:

Heroglyphs Ticker Alias by detoo

Vitalik’s Warning Against LSD/LRTs

In a recent blog post, Ethereum Co-Founder Vitalik Buterin asked the question “are we building toward the right goals?” In the post, he explored three major issues: MEV (miner or maximal extractable value), liquid staking, and the hardware costs of running a solo node, which have radically transformed the infrastructural operation of the network.

“Incorrect answers could lead Ethereum down a path of centralization and 're-creating the traditional financial system with extra steps'; correct answers could create a shining example of a successful ecosystem with a wide and diverse set of solo stakers and highly decentralized staking pools," Buterin writes.

For better or worse, Ethereum has been radically changed since its launch in 2017. LSDs/LRTs and centralized staking, plus off-chain mempool building (a la Flashbots) are market driven products that have disincentivized solo staking. Vitalik notes 3 major trends why people elect third party staking services:

32 ETH is expensive to acquire

Running and maintaining nodes is challenging

Lack of access to DeFi

While hardware costs may be prohibitive, with the cheapest Dappnode costing $1500, it’s the first and third reasons why solo staking has lost popularity.

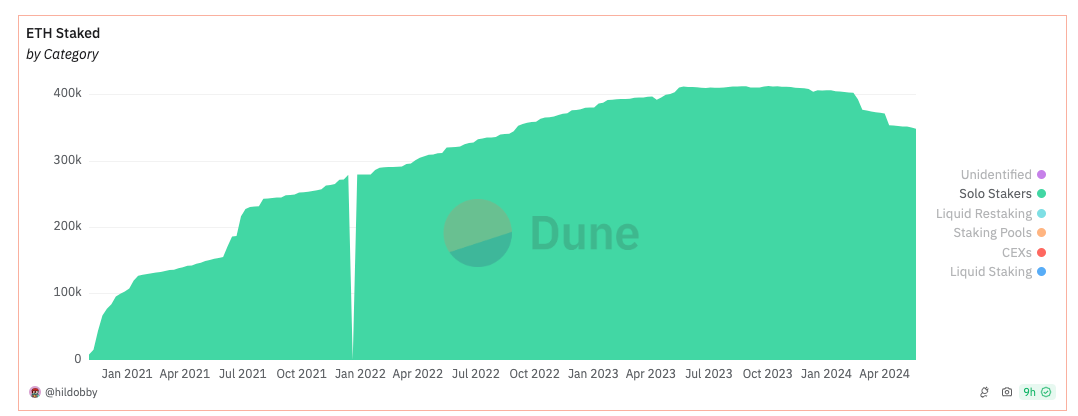

According to this Dune Dashboard by batman, solo stakers represent around 1% of the total share of ETH staked, down from around 15% back in Jan 2021. These numbers are for “complete validators” as Heroglyphs call them, which excludes “solo” stakers in Rocket Pool. Complete validators operate their own infra, run their own code, and don’t have access to any LSDs, LRTs, or LSDFi.

You have to be a true purist to purposefully eschew debt, leverage, and all the other apps in DeFi. Pendle PTs for LRTs are paying 25% for guaranteed yield versus the paltry 3% a solo staker would earn annually.

In the same time period where Lido amassed upwards of 9m ETH staked, Coinbase 4.3m, Ether.fi 1.2m and Renzo 1m, and Binance 1m, solo stakers have yet to break 400k ETH staked.

The economic incentives of “decentralized” or centralized staking pools vastly outweighs the inherent security benefits provided by solo stakers. LSDs/LRTs/Centralized services offer greater capital efficiency, professionalized infrastructure, DeFi integrations, and governance power through token yields. These services are just easier to use and the market agrees wholeheartedly.

But they have centralization tradeoffs that create new systemic risk threats for Ethereum’s security at scale. Just late last year Lido’s share of total stake broke 31%, raising alarm bells for many. If any one entity is able to amass more than 33% of stake weight, it theoretically can manipulate block space for its own benefit. Lido shrugged off the accusations, saying their interests were “aligned” with the broader Ethereum community.

For a full discussion on this 33% stake weight discussion, check out Strange Water Podcast with Superphiz. It’s a valid concern on the long term health of the network, but no solutions have provided better economic incentives for actors to shift to solo staking.

That is until now with the upcoming deployment of Heroglyphs.

Heroglyphs is a new protocol designed to create new economic incentives only available to solo stakers aka “complete validators” to create new token distribution methods. The idea is relatively simple, but the implementation is incredibly complex.

Heroglyphs creates a new value layer for solo stakers through its novel execution system. Every time a validator is selected to be the block producer, if they have Heroglyphs readable text in their Graffiti field, it can execute a contract. For its current phase, this means being able to claim new issuance of memecoins. Additionally, all the validators that attest to the block producer get points and then swap them for the token of their choosing.

On its face it’s a relatively simple process. Heroglyphs is going to try and fix the broken solo staking incentives with memecoins.

Memecoins are the lifeblood of crypto.

Bitcoin is arguably the biggest memecoin and it had one of the “cleanest” and most “immaculate” token distributions in history. For the first couple of years, anyone with a computer could just run the mining software and earn some BTC. Bitcoin arguably has the best distribution across participants of any crypto in existence.

From Ethereum onwards, almost every major project now sets aside tokens for teams, insiders, VCs, KOLs, treasury and whatever other categories they can come up. Even after deployment tokens are bought up by insiders with undisclosed addresses. The whole process has given crypto a bad name and left a bad taste in traders mouths when their tokens go down only 99%.

With their new value layer, Heroglyphs is able to create a new fair, equal distribution method that rewards solo stakers with memecoins. If successful the protocol will change market dynamics and attract stakers away from LSD/LRTs/Centralized services.

Memecoins are just the beginning. In the future, we might see onchain games, NFTs, and other apps built using Heroglyphs. But for now memecoins are the kickstarter, the fastest way to create new communities and attach financial value to the protocol in its infancy.

Heroglyphs, Bitcoin Ordinals and Runes

Heroglyphs was inspired by Bitcoin’s Ordinals and Runes inscription mechanisms, which used OP_RETURN and Unspent Transaction Outputs (UTXOs), to “etch (deploy)” new tokens.

Runes allowed use of a small data storage system on Bitcoin to house the data and allow it to be interpreted for token deployment and management.

Just a few months ago, the Heroglyph’s team travelled to Taiwan to hook up with the PleaserDAO community to listen to Wu-Tang Clan’s “Once Upon a Time in Shaolin.” While chilling to the unreleased beats, the Heroglyph’s team had an “aha” moment when exploring how Runes/Ordinals could be translated to Ethereum. This was that Ethereum has a field called Graffiti, where validators can post any 32 byte text.

Before Heroglyphs, this graffiti field went largely unused. It was just a way for a validator to share a phrase or text, or draw dickbutts on the "Graffitiwall.”

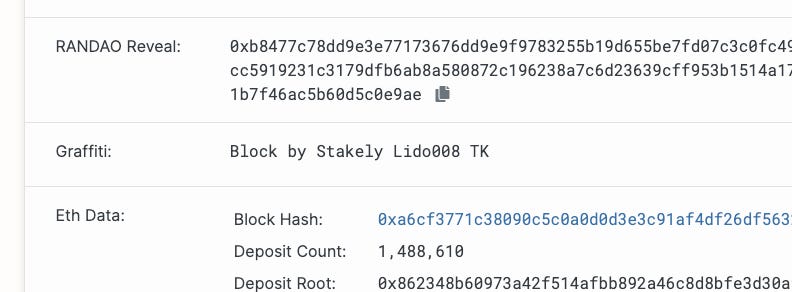

Here’s a random block we just pulled for this article. The block was produced by Lido and they used the graffiti field to write their operator information. The text is arbitrary, but they used it to show the block was produced by them.

Inside the Graffiti field validators can write in UTF-8 up to 1 million different characters using Unicode that uses 1-4 bytes. The only limiting factor is the 32 byte limit. We’ll take a look at that syntax in the next section on tickers, and User Ids.

One of the biggest differences between Ordinals/Runes and Heroglyphs is that use of the graffiti field doesn’t bloat the state. Grafitti is already included in every block. Even if every graffiti field characters are maxed out, its effect on state growth will be negligible.

Coming back to the “aha moment,” the Heroglyph’s team figured out that while any validator can attest to a token, even LSD and LRT providers, additional filters can be added which would exclude their participation. Here’s what is required:

Deactivate mev-boost

Using a relayer that doesn’t censor or filter

EOA withdrawal address

These three requirements filter out almost every LRT/LSD and most centralized platforms. While it's not perfect, it does narrow down the eligible participants to those who function like a solo staker.

Heroglyph Syntax: Tickers & Ids

Heroglyphs are built on a new syntax system for the Graffiti field that allows it to be readable and then translated to on-chain events/execution. This system is called “Encoding and Translating.”

Validators “encode” text according to the Heroglyphs syntax inside the Graffiti field, and then it’s “translated” on-chain for execution. For Phase 2 this translation is used to create, initialize and mine tokens, but in later phases more use cases will be added.

Heroglyph Graffiti syntax is constructed with the following format:

#precedes the tickers' names, separated by commas.@precedes the Graffiti Id's name.-precedes the global chain to execute all tickers on.

In the above picture, the ticker is #frxbullas. This ticker is 9 characters long. That’s not the best use of space in the Graffiti field.

But a smart little Fraxbull could buy the ticker #f and point it at the #frxbullas contract. Now when they write Graffiti, they can economize space with a single character.

Short tickers, especially single character 1 byte (there’s only 256 of them btw), will command a high premium.

When tickers are created, the owner chooses its name and a yearly lease fee, which is paid linearly. If your deposit goes to zero and you don’t top it up, you’ll lose the ticker.

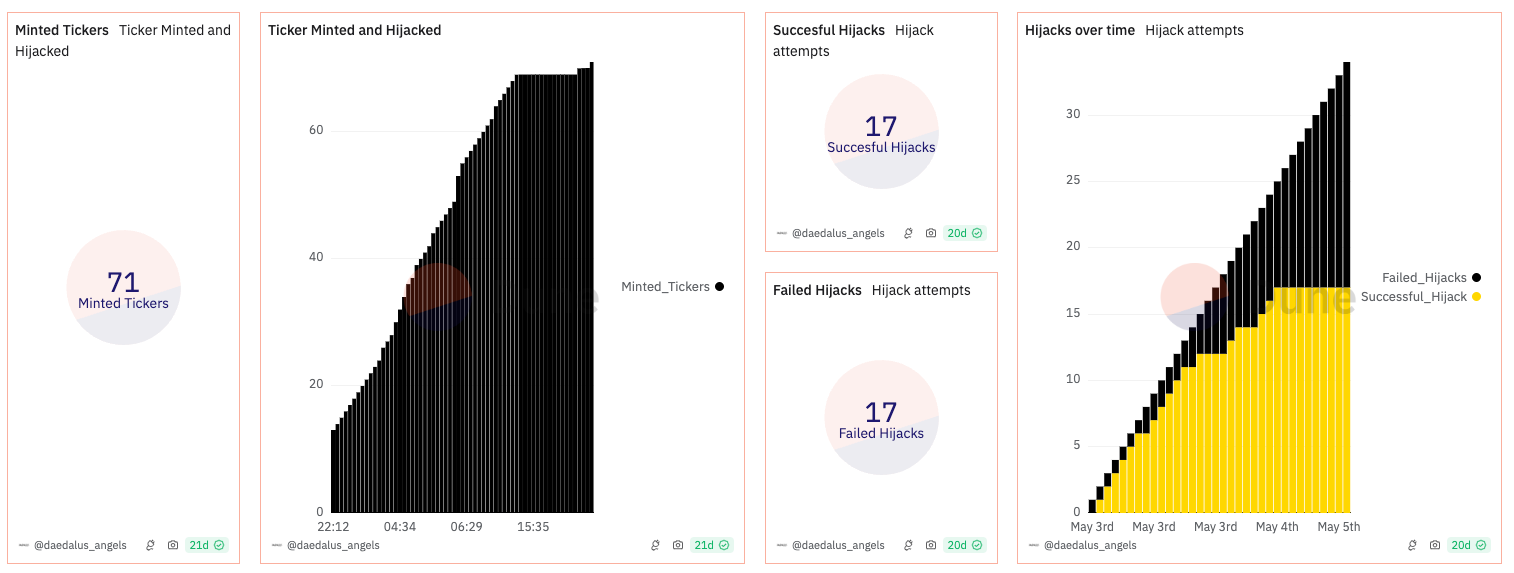

Tickers can be “hijacked” if another person pays a higher leasing fee. The original owner has 7 days to outbid the hijacker, and if they don’t they lose the ticker. Once hijacked the new owner can choose where to point the new ticker. Ticker fees should be the primary source of revenue for the protocol after it launches.

The whole tax/leasing system is a a bit wonky on its face, but it makes sense. Tickers prices should be market set, and prevent squatting.

Already we are seeing Tickers hijacked even before the protocol goes live.

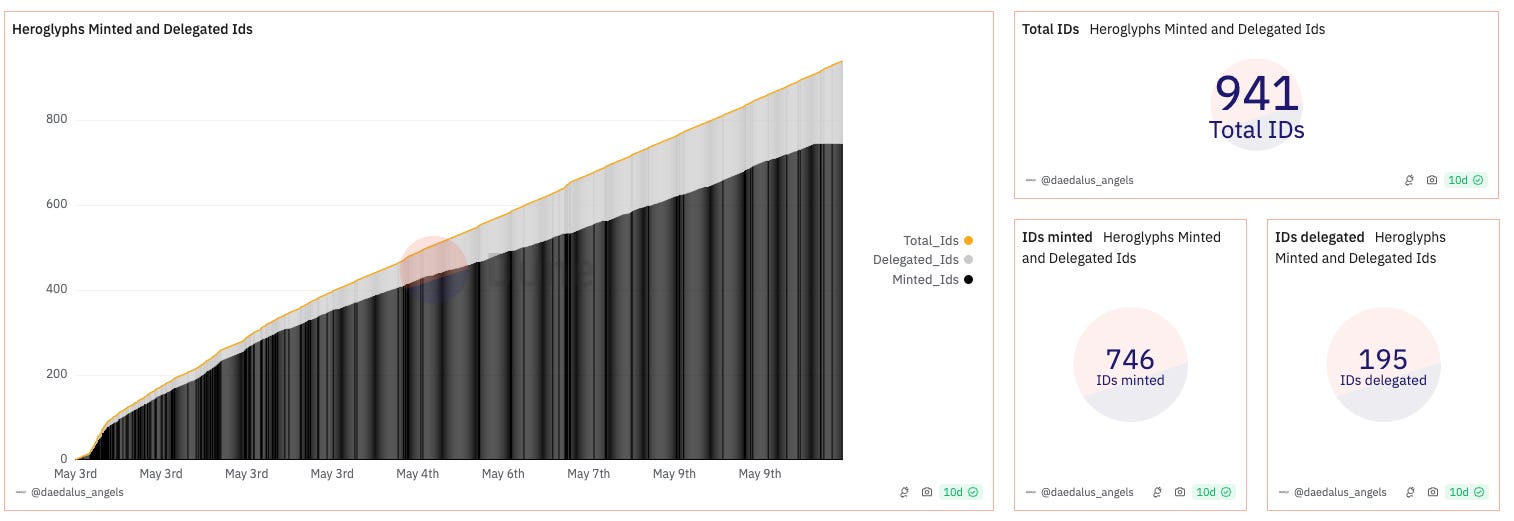

The way the translator knows which complete validator is posting the Grafitti is with an Id, a soulbound, immutable identifier that can be purchased through Heroglyphs. Ids also share the same byte limits in the Graffiti field as Tickers, so the shorter the better. Id’s cost 0.1 ETH to mint.

As a resident Fraximalist, I would purchase the ¤ currency symbol for my validator, then to mine #frxbullas, I’d then purchase the associated NFT-Keys (more on this in the next section) and also the #f ticker to maximize economy of space. To mine the #frxbullas token, I would write the following to the Grafitti field:

#f@¤

2 characters. Winning. Every time my validator is selected to be the block producer, I get #frxbullas tokens.

If I wanted to also mine a, l and s I could add those tickers into my Graffiti:

#f,a,l,s@¤

More winning. Retardio.

Memecoins, Tickers and NFT-Keys

So just to review, Tickers point at a contract and allow the protocol to translate your Graffiti into executable actions/events like minting memecoins or NFTs. Complete validators can add any Ticker to their Graffiti and the protocol spits out new supply when they are the block producer.

All of the validators that attest to a token are also awarded medals. Complete validators must claim their medals within 30 days or they expire. Medals can be redeemed for Arbitrum-based soul-bound $BADGES.

In Phase 2, the Heroglyph’s team has created 14 different “Genesis” tokens on 11 networks that can be redeemed for $BADGES at a fixed exchange rate. Here’s a list of the tokens:

Contracts:

MOLANDAK - Arbitrum (will migrate to Monad) - 0xA170Eaa9a74ab4b3218C736210b0421aF35C3c00

LUEYGI - Avalanche - 0xcCF580E697B8bBA73748BA881C1872DD4fB01cdA

PORIGON - Polygon - 0xC3323b6e71925b25943fB7369EE6769837e9C676

OVERPOWERED - Optimism - 0xfe5B10F053871e66a319a57a16CF4e709f51367F

ARBINAUTS - Arbitrum - 0x836975C507bfF631FCD7FBa875e9127C8A50dBa6

69 - Mantle - 0x74262b38609a4155EaB4eEcFDcD0E339Da2cF1b2

ONEPUNCH - Linea - 0x1F63D0EC7193964142ef6B13d901462d0E5CbB50

KABOSU - Base - 0x9e949461F9EC22C6032cE26Ea509824Fd2f6d98f

SCRIBES - Scroll - 0x750351a9F75F98f2c2E91D4eDb3BeB14e719557E

frxBULLAS - Fraxtal - 0x3Ec67133bB7d9D2d93D40FBD9238f1Fb085E01eE

GNOBBY - Gnosis - 0x1a8805194D0eF2F73045a00c70Da399d9E74221c

GARFELDO - Arbitrum (will migrate, network unknown (SOL maybe?)) - 0x344C796cc2474e4b779D0e81765AFB91D7741a42

Ooga Booga - Arbitrum (will migrate to Berachain) - 0x4e6b45BB1C7D11402faf72c2d59cAbC4085E36f2

Each Genesis token has its own ticker (i.e. #frxbullas used in the example above), supply cap and distribution rate. Check out Ken’s Heroglyphs Player’s Handbook for details on each token.

Tokens have a linear distribution and can be earned from either being the block producer or earning points as an attester and then swapping their $BADGES.

To prevent widescale sybil farming, where a single entity spins up thousands of complete validators to earn medals, farm tokens and dump, validators are required to purchase an NFT-KEY.

NFT-KEYs gate mining privileges, so if you don’t have one, you won’t earn medals, even if you attest the correct Graffiti for the ticker.

The number of NFT-KEYs associated with each Genesis token varies based on price and supply, similar to the token mapping above.

For example, the $GARFFELDO NFT-KEY has no cap and a minimal mint price of 0.0016 ETH ( $6), while the $MILADY NFT-KEY has an unknown cap and a mint price of 100 ETH ($380,000!).

Over $6m worth of NFT-KEYs have sold so far. Any NFT-KEYs for Genesis tokens that mint out will also be eligible for an Icedrop. 1% of the total Genesis token supply will be airdropped to NFT-KEY buyers on a vested time scale with a cliff. Details on the length of the vest have yet to be announced.

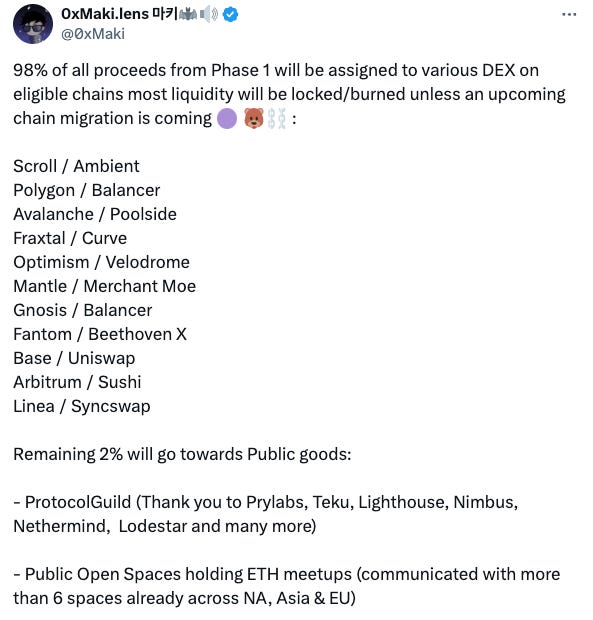

From the sales, 98% of all the funds raised will be used to seed the initial LPs on their associated networks. The remaining 2% will be directed towards public goods funding.

Another mechanism the Heroglyph team has added to reduce sybil farming is an aggressive redeem penalty. With over a million ETH validators currently securing the network solo validators have the following probability to be block producers:

Chances of being block producer in 1 hour 0.0297%

Chances of being block producer in 24 hours 0.7116%

456 identities have been minted so far, which means that Heroglyphs tokens should be minted around 3-4 times daily.

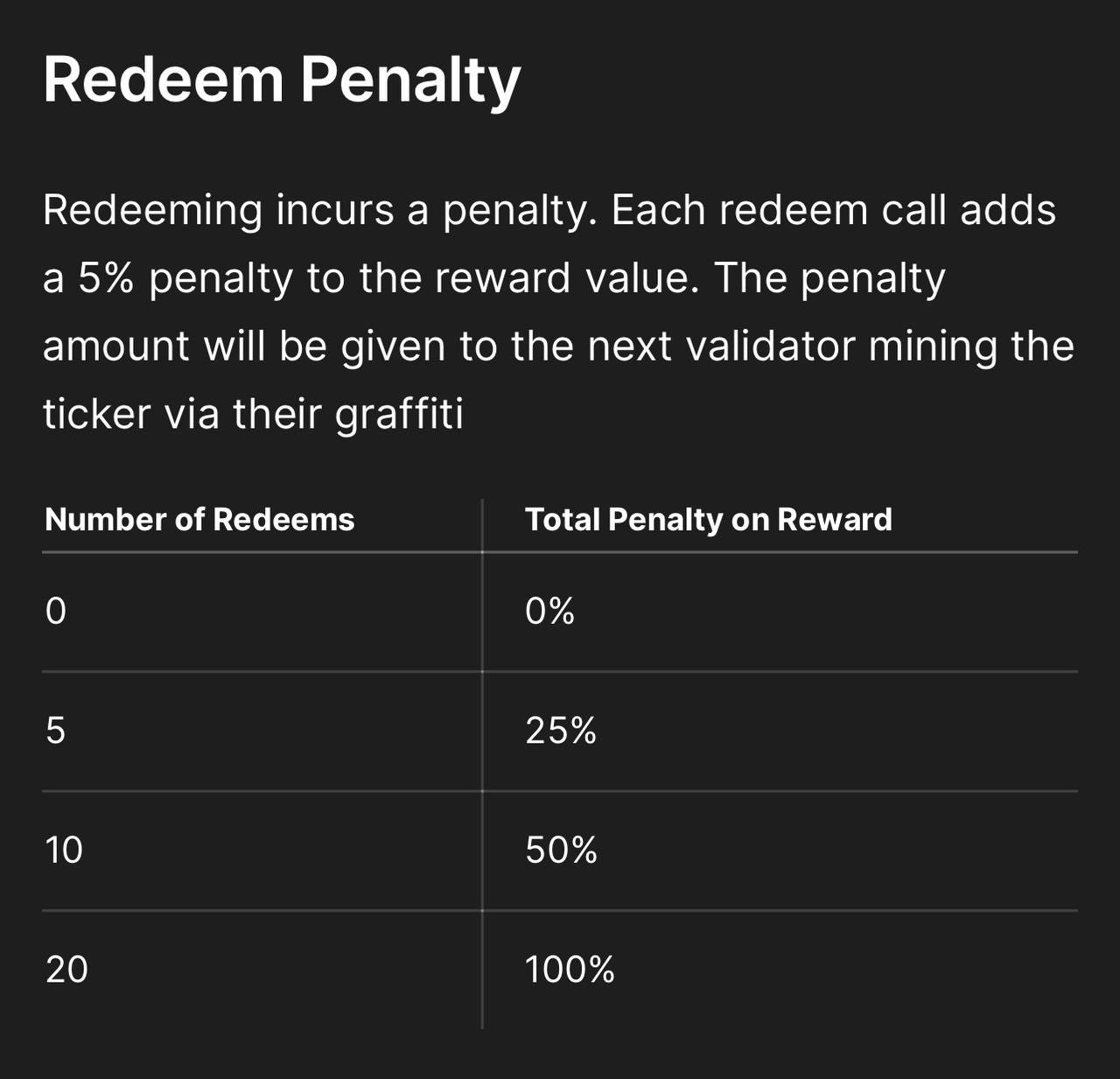

If the number of potential identities jumped to 10,000, then the total number of redeems will increase to 60-70 times daily. Heroglyphs adds a redeem penalty on every subsequent mint within the last redeem call. So after the redeem function has been called 20 times, validators will be incentivized to shift their Graffiti towards other tokens to mine.

Modern Day Merge Mining

The closest reference to Heroglyphs we can find in crypto’s short history is merge mining.

Merge mining is a technique that allows two different cryptocurrencies to be mined simultaneously using the same computational effort. This process involves leveraging the work done on a primary blockchain (the parent blockchain) to also secure an auxiliary blockchain. When a miner solves the cryptographic puzzle required to mine a block on the parent blockchain, they include data from the auxiliary blockchain in the block header. This allows both blockchains to independently verify the same proof-of-work, effectively enabling miners to mine two cryptocurrencies at once without needing additional computational power.

Heroglyphs renews merge mining for Proof of Stake. On the Flywheel Podcast 0xMaki said “The beauty of POW is that anyone can just spin up some hardware and just come and mine There's an emission schedule, there's a difficulty. POS is very different. It's basically a money game where the rich gets richer. With Heroglyph anyone can spin a validator and mine these tokens.”

Heroglyphs brings back the egalitarian nature of token distribution to POS networks. It equalizes the ability of participants to earn tokens, leveling the playing field and ensuring that all participants play according to the same rules. It’s a system that we haven’t seen for a very long time and could help “fair” token launches reemerge in the same spirit of Bitcoin.

It’s this reason that Heroglyphs has a chance to define the memecoin meta on Ethereum for this year, as new participants flock to the “immaculate” distribution curves previously only employed by Proof of Work systems. Whether the market values this in 2024 we will find out later this year, but based on the massive roadmap the Heroglyph team has, it might just become the biggest infrastructural game design spurring an entire new wave of memecoins.

Beware of Affiliated Scam Projects

One project we ran across claiming to be building with Heroglyphs was graffiti.farm and their token GRAF. We asked the Heroglyphs team about this and they expressly denied its involvement, calling it a scam. Always DYOR and hop into the Heroglyphs Telegram/Discord and ask questions if you have any.