When Quantum Computers Attack (And Ethereum Fights Back)

Ethereum’s $2 million race to outrun the quantum apocalypse, Senate hurdles for the CLARITY Act, and why Colombia’s retirees are getting “Bitcoin-curious.

So here’s a fun question: What do you do when the computers that secure your blockchain are about to be made obsolete by... other computers?

If you’re the Ethereum Foundation, apparently you throw $2 million at the problem and hope really smart people figure it out before the quantum apocalypse arrives.

The Foundation announced last week that they’re launching a dedicated Post-Quantum Security Team, led by Thomas Coratger, because—and I’m paraphrasing here—quantum computers are coming to eat everyone’s lunch, and they’d prefer their lunch remain uneaten.

Justin Drake, the Ethereum researcher who announced this with characteristic flair, put it succinctly: “It’s now 2026, timelines are accelerating. Time to go full PQ.”

Now, “going full PQ” sounds like something you’d order at a trendy restaurant (”I’ll have the post-quantum, medium rare”), but it actually means preparing for a future where quantum computers can crack current cryptography like a particularly determined squirrel opening a bird feeder. The thing about quantum computers is they’re very good at solving certain mathematical problems that current encryption relies on. It’s like if someone invented a master key that could open every lock ever made, except the locks protect trillions of dollars and the entire concept of digital ownership.

The Ethereum team has been thinking about this since 2019—back when quantum computers were more theoretical curiosity than imminent threat. But 2026 has brought some uncomfortable realities. As Drake noted, a recent $200, 8-hour AI math run completed a complex cryptographic proof that would have taken much longer before. When your cryptographic assumptions are being stress-tested by artificial intelligence for pocket change, it’s probably time to take quantum threats seriously.

The Foundation’s response is admirably comprehensive and slightly chaotic, as befits an organization trying to quantum-proof a trillion-dollar network. They’re running multi-client post-quantum consensus devnets—which is fancy talk for “we’re testing our quantum-resistant code on fake versions of Ethereum to see if it breaks.” Teams with names like Lighthouse, Grandine, Zeam, and Ream Labs are participating, which sounds less like a blockchain consortium and more like a fantasy football league for cryptographers.

The $2 million in funding breaks down into two $1 million prizes: the Poseidon Prize for hardening the Poseidon hash function (used in zero-knowledge proofs), and the Proximity Prize for mathematical strengthening of hash-based cryptography. The choice to focus on hash-based solutions is telling—it’s like choosing to build your fortress out of concrete instead of cardboard when you know siege engines are coming.

But here’s what’s really interesting: this isn’t just about Ethereum surviving quantum computers. It’s about the entire premise of decentralized systems in a post-quantum world. Current blockchain security assumes that certain mathematical problems are hard to solve. Quantum computers don’t care about your assumptions. They’re coming whether you’re ready or not, and they’re bringing algorithms that can factor large numbers and solve discrete logarithms faster than you can say “private key.”

The Foundation is also planning bi-weekly “All Core Devs PQ transaction breakout calls” starting next month, which sounds like the world’s most important and boring conference call. They’ll cover precompiles, account abstraction, and signature aggregation—the unglamorous technical details that separate functional quantum resistance from expensive quantum security theater.

There’s something beautifully absurd about all this. Here’s a technology that was invented to eliminate trusted third parties, now frantically rebuilding itself to survive an attack from a technology that doesn’t quite exist yet at scale. It’s like renovating your house to be earthquake-proof while the earthquake is still being invented in a laboratory somewhere.

The timeline is aggressive: they’re planning a PQ workshop in October and a PQ day in Cannes before EthCC, with a full roadmap at pq.ethereum.org targeting a “zero-loss transition.” Zero-loss sounds optimistic for a fundamental cryptographic migration, but admirable in its ambition. It’s like saying you’re going to perform heart surgery on a marathon runner without breaking stride.

What makes this particularly fascinating is that Ethereum isn’t just protecting itself—it’s potentially setting the standard for how all blockchain networks handle the quantum transition. Get it right, and you’ve solved one of the most fundamental challenges facing digital assets. Get it wrong, and... well, let’s just say there are worse things than gas fees.

The real test will be whether they can maintain Ethereum’s core properties—decentralization, permissionlessness, security—while completely replacing its cryptographic foundations. It’s the equivalent of rebuilding the engine of a car while driving down the highway at 70 mph. Except the car is worth a trillion dollars, the highway is the global financial system, and the new engine uses physics that most people barely understand.

Still, if anyone’s going to pull off this quantum magic trick, it’s probably the people who convinced the world that math could be money in the first place.

🗞️ IN OTHER NEWS

CLARITY Act Hits Senate Turbulence

The House-passed CLARITY Act faced setbacks in the Senate when the Banking Committee postponed its January 14 markup after Coinbase CEO Brian Armstrong and other industry players withdrew support for the revised text. The delay preserves bipartisan negotiations while highlighting the fragile consensus on crypto regulation details. Two competing discussion drafts emerged from Senate committees, with Agriculture scheduled to mark up its version January 27.

Colombia’s Pension Fund Goes Bitcoin-Curious

AFP Protección, Colombia’s second-largest pension fund with $55 billion in assets under management, launched a Bitcoin-linked investment fund for qualified investors. The optional fund allows limited Bitcoin exposure without replacing traditional pension allocations, following Skandia’s precedent from September 2025. 8.5 million clients can now add crypto diversification to their retirement portfolios through personalized advisory processes.

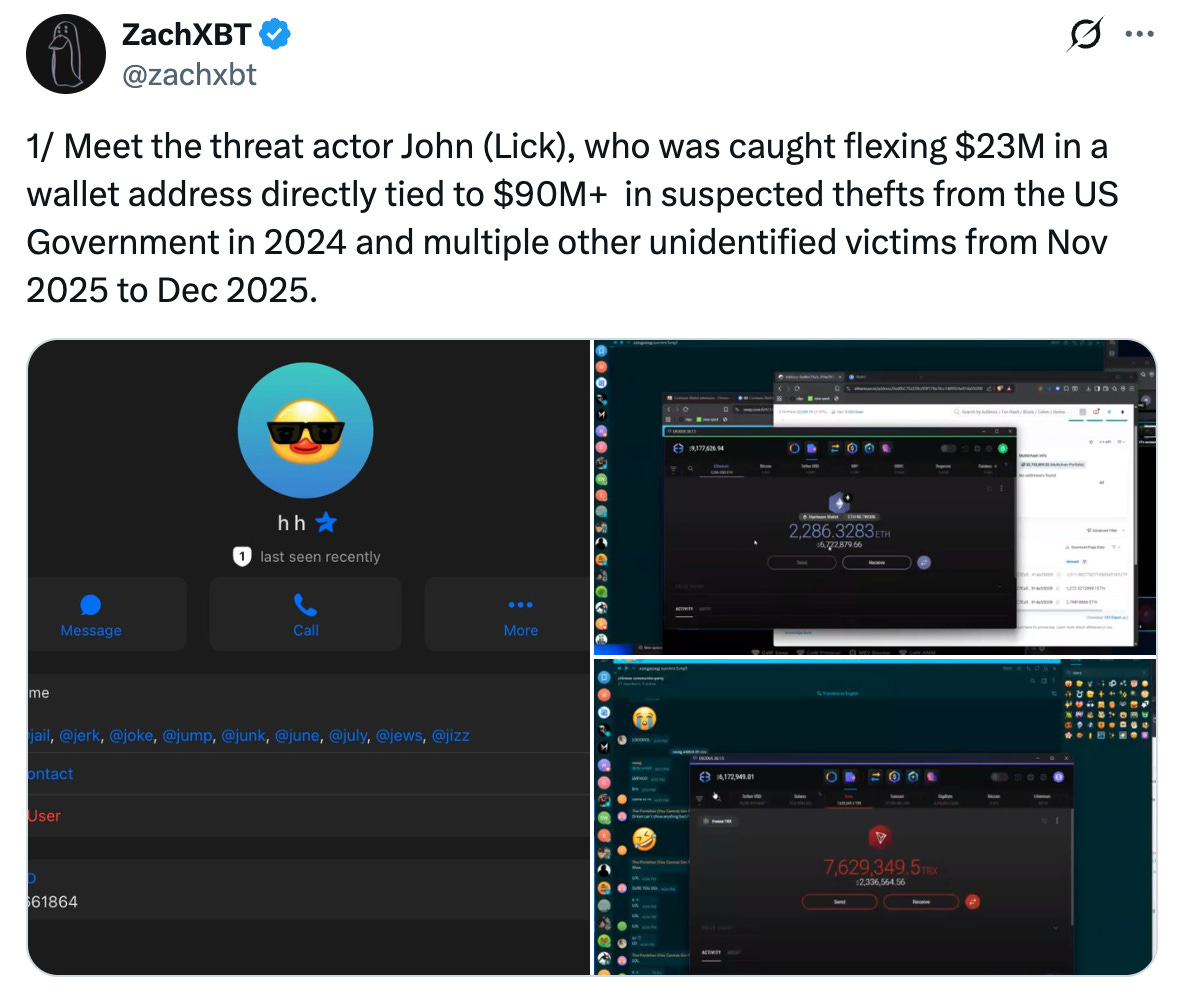

ZachXBT Traces $90M+ Government Theft Ring

Blockchain detective ZachXBT exposed a $23 million wallet linked to over $90 million in suspected stolen funds from U.S. government seizures, primarily tied to the 2016 Bitfinex hack. The investigation started with a recorded Telegram video where hacker “John (Lick)” flexed cryptocurrency holdings, allowing ZachXBT to trace backward through fully documented on-chain transactions revealing connections to government seizure addresses from March 2024.

Nifty Gateway Pulls the Plug

The NFT marketplace Nifty Gateway announced its closure effective February 23, 2026, immediately switching to withdrawal-only mode. Users must transfer USD, ETH, and NFTs before the deadline or risk permanent losses of potentially millions in assets, including works by major artists like Beeple. Gemini cited refocus on its “one-stop super app” strategy as NFT market conditions continue declining from 2021 peaks.