I’ve been doomscrolling too much and I had to delete X from my phone today.

After months of nasty ETH hate on the timeline, we’ve reached a point where the haters are just grave dancing and losing the plot.

ETH is down 54% from ATHs this year alone in 2025.

SOL is down 23%, BTC is down 3.78%. And freaking XRP is up 3.78%.

It’s just sad at this point the loss of investor confidence in the most promising asset to change the world at scale other than Bitcoin. Good intentions don’t often translate to high value.

I’ve felt a vibe shift in the last couple of weeks:

1.) All of the goodwill given to the L2s (Base, Arbitrum, etc) is now gone. While these networks are Ethereum “aligned” the introduction of blob pricing has led to a massive reduction in fees captured by the L1.

No one wants ETH to become Cosmos, which has a rich, diverse set of networks, but the L1 captures little value.

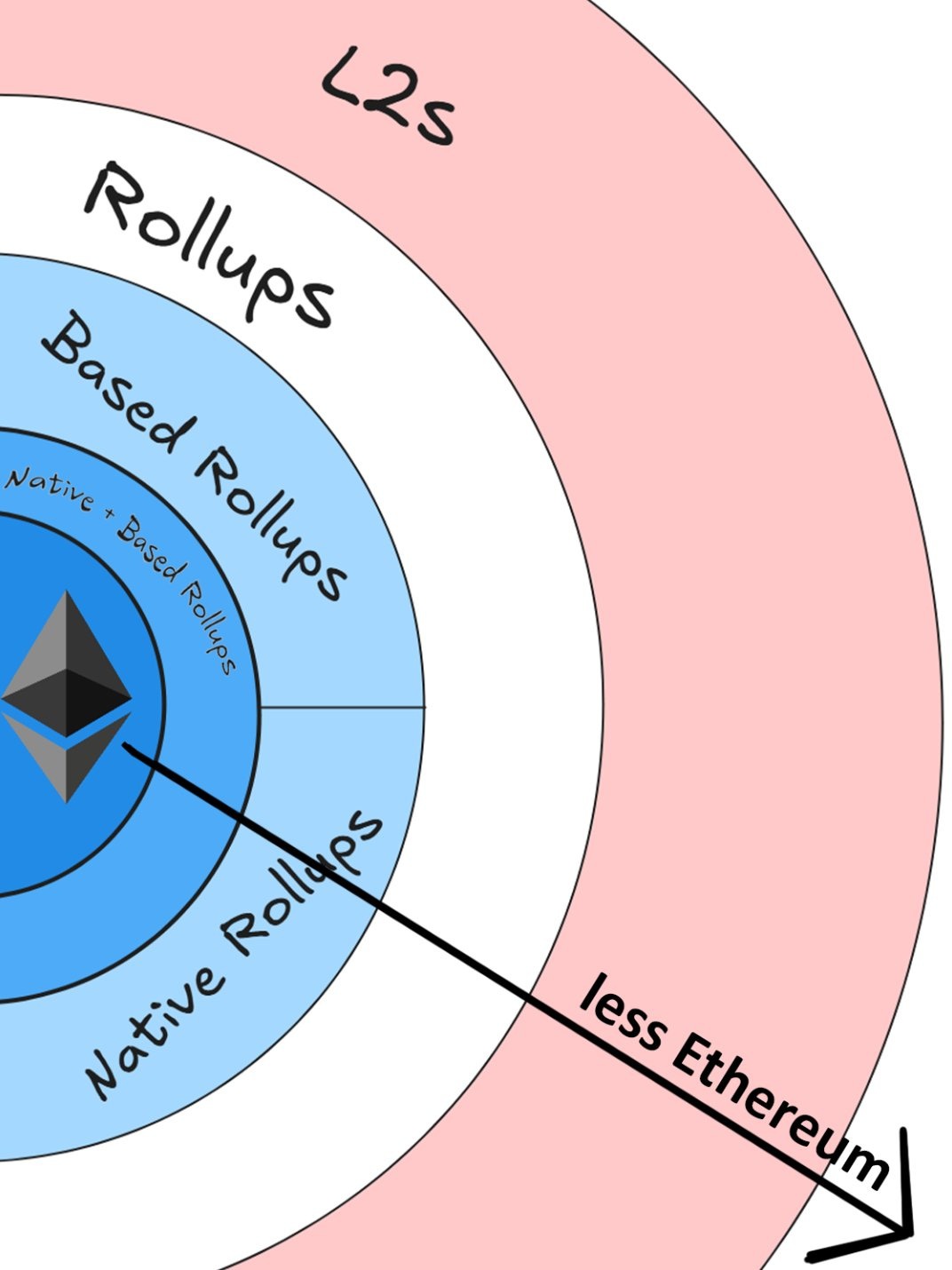

David Hoffman from Bankless posted this great photo showing that while L2s are “aligned” with Ethereum, the strength of that relationship is greatly diminished versus other forthcoming technologies like Based and native rollups.

The vibe shift with the L2s will be the biggest change needed to return value to ETH. We can’t abscond our users and TVL to Base, a corporate Fed-chain currently sitting at Stage 0(!). I didn’t sign up for this.

2.) High prices made us forget why we were here in the first place, which is to create a permissionless, open source, trustless consensus layer that will power the future of Finance (and maybe some other verticals). As of writing, the only proven use cases for crypto so far is Bitcoin (as a ‘savings’ vehicle, ETH + it variants and stablecoins).

When I first came into crypto, it was to support grey market activities which were disfavored by the incumbent banking system. Guns, drugs, sex work, and Wikileaks were the original appeal crypto cast over me. It was a purely counter-cultural preference for independent systems that could stand strong against censorship and repression.

Those days are gone. Now all the new blood in crypto is simply devising ways to max extract from their communities. Either its smart money VCs and other instituional capital allocators driving pre-seed/seed valuations higher to the point where retail no longer has an edge simply becomes exit liquidity. Or in the memecoin trenches fighting against the multitude of scammers, rug pulls, and other nasty PVP combat that only a small few profit from.

I don’t actually know if this can be fixed tbh. But we do need to return to the roots and stay in wartime mode even with regulatory pressures easing.

3.) We bullied the EF enough to implement substantial changes. Aya Miyaguchi resigned as Executive Director to President, leading to the appointment of Hsiao-Wei Wang and Tomasz Stańczak as co-Executive Directors.

Vitalik is now focused on long term research like exploring RISC-V architecture for the Ethereum Virtual Machine. The EF as a whole is now focused on L1 scalibility rather than offshoring to L2s.

4.) Specifically for ETHBTC lets do some back of the napkin math.

If you assume the worst-case scenario for Ethereum and the best-case scenario for Bitcoin, ETHBTC bottoms out ugly. Let’s say ETH drops to $1,250 and BTC rallies to $120,000. That gives you a ratio of just 0.0104.

Disgusting. But that’s ONLY another 40% decline from these levels.

But if ETH claws its way back to something more reasonable, like its 180-day EMA at $2,782, and BTC hits $120K, you get ETHBTC = 0.0232.

Still weak, but not catastrophic.

Push ETH to its 365-day EMA around $2,886, and ETHBTC edges up to 0.0241. If BTC doesn’t blast off and instead holds around $95,000, ETHBTC improves:

0.0293 at the 180-day EMA

0.0304 at the 365-day EMA

So depending on where ETH finds its footing, ETHBTC can recover somewhat. But the only way we get that recovery is if people start believing again. Right now, it’s clear the bid has vanished. ETH has lost the attention, the momentum, and the narrative. And until that comes back, this ratio won’t either.

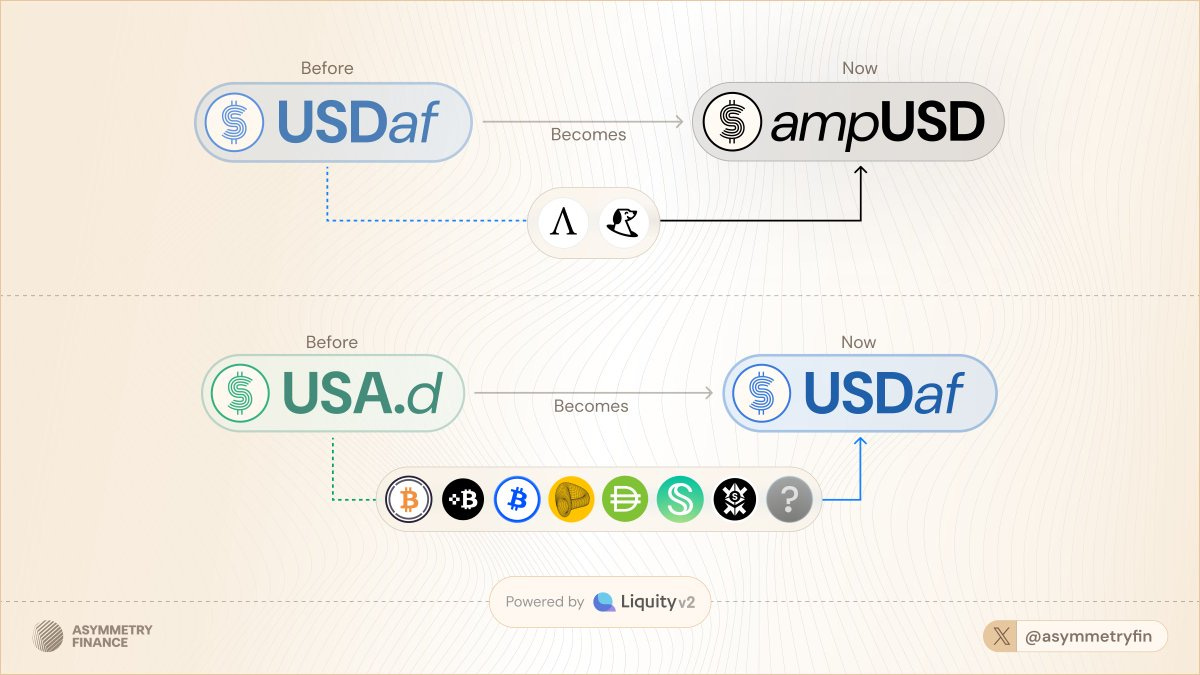

Asymmytry renames their stablecoins

Wdyt? Easier to understand? Leave a comment below.

Railgun launches Mech accounts with Gnosis Guild

Railgun is teaming up with Gnosis Guild to integrate Mechs. Basically, NFTs that can own smart contract accounts.

This lets RAILGUN’s 0zk addresses do more complex DeFi things like lending, borrowing, or multi-sig signing while keeping everything private with zero-knowledge proofs. It’s a practical step toward making Ethereum useful again for stuff like staking on Lido or swapping on CoWSwap without everyone knowing your business.

The way it works is straightforward. 0zk addresses prove ownership of a Mech account, unshield tokens to interact with a contract, then reshield everything so it stays private, even for things like unstaking that take multiple steps.

This integration aims to expand RAILGUN’s reach into broader DeFi applications, such as liquid staking on Lido or intent swaps on CoWSwap, enhancing privacy on Ethereum’s layer 1. The proposal is currently up for a vote among $RAIL stakers, and RAILGUN is hosting a Spaces event on April 23, 2025, to discuss the details with the community.

Bitcoin Mission hacked for $1m

Bitcoin Mission has been exploited due to a critical smart contract vulnerability, resulting in over $1 million in stolen assets by April 22, 2025. The issue stemmed from flawed logic in the overPaper function, where improper sender validation allowed malicious actors to bypass access controls and withdraw large sums of USDT.

This bug wasn't tied to low-level technical failures, but rather to oversight in the contract’s business logic, a type of error frequently cited in OWASP smart contract security guidelines.

The stolen funds were rapidly moved across chains, using laundering techniques similar to those deployed in past nation-state-backed attacks run by Lazurus.

Share this post