Another blow up the size of Terra Luna took place over the weekend and barely anyone is talking about it.

Over the weekend, the $OM token from Mantra, a project positioning itself at the center of real-world asset tokenization, collapsed more than 90% in under an hour.

The price nuked from $6.21 to under 50 cents, wiping out nearly $6 billion in market cap.

It’s the largest marketcap blow up in crypto since Terra Luna.

Let’s walk through what we know.

First, on-chain data shows that 17 wallets two of which are linked to Laser Digital, a strategic investor, deposited over 43 million $OM tokens to exchanges starting around April 7.

That’s $227 million worth at the time, or 4.5% of supply.

The bulk of those tokens hit OKX in the days leading up to the crash.

Then, on Sunday, it all unraveled.

Massive sell pressure hit the books. CEXs like Binance and Bybit started liquidating leveraged positions. Within minutes, a cascade of forced closures dragged the price down 90%.

John Patrick Mullin, Mantra’s co-founder, claimed this was due to "reckless forced closures" on exchanges, basically blaming centralized liquidation engines.

But that doesn’t explain the timing of those wallet movements or why investor-linked accounts were suddenly dumping.

Laser Digital came out denying everything, saying they didn’t deposit or sell any tokens. But their tagged wallet addresses are all over the transaction logs.

We weren’t surprised about the blow up.

Mantra is not loved by CT insiders. It had a FDV of $9bn, off a TVL of just $13mn. Token unlocks were coming. And over 90% of supply was controlled by insiders and core investors. OM was also up 300x since last year. You can do the math.

We also follow Crypto Condom who has been harping on the TL for months about these fake FDV projects that have abused their supply dynamics to pump their tokens to astronomical valuations.

Based on the chart its relatively easy to figure out what happened with OM.

A fund or investor was using OM as collateral on exchange for trading operations. With the 300x rise in OM over the past year, a massive amount of credit had been unlocked for them.

They then used this credit to trade, borrow captial and fund their own money making operations.

Because the OM supply was so controlled amongst a few well known insiders and the team, it didn’t take much liquidity to juice the market cap and push OM to $9bn valuation.

According to on-chain detective ZachXBT, the real culprits may be two familiar names: Denko Mancheski, the founder of Reef Finance, and Fukogo Ryoshu. Zach says that through his own contacts, he learned that both had been borrowing aggressively using $OM as collateral in the days leading up to the crash. They were reportedly shopping around for massive loans, using their $OM holdings to back them.

Then the price dipped.

Their positions were liquidated. Market makers, likely aware of how overexposed these borrowers were, yanked their liquidity to protect their books. With no liquidity left to catch the falling knife, $OM crashed straight through the floor to 50 cents.

Here’s a theory. The market makers knew about the size of the loan deals and the risk to their own operations. If they had left their liquidity up during the liquidation, they would have been the exit liquidity. So they stepped back. Prices fell until someone was willing to catch it. That someone was not the OM team, not the borrowers, and definitely not retail.

This brings us to the real question. What did the Mantra team know? Were they aware that these two whales were borrowing at scale against $OM? Did they give it a green light because those inflated valuations propped up their market cap?

These are not small-time traders.

These were players who held enough OM to break the market, and break it they did.

And now? It’s damage control.

Everyone is scrambling to figure out who is actually at fault. The market is searching for someone to blame. But the truth is, it might be all of them. The borrowers. The liquidity providers. The team. The investors who looked the other way.

One thing is clear, the illusion of OM’s valuation has shattered. Mantra may have had regulatory licenses and a $100 million RWA fund lined up, but that doesn’t mean much when confidence disappears in a single hour.

The token is still trading under 60 cents. The team is still pointing fingers at centralized exchanges. The community is furious. And no one really believes that this was just a random liquidation event.

The next question we should be asking is what other tokens share similar inflated FDVs?

Condom has long thought ONDO is next.

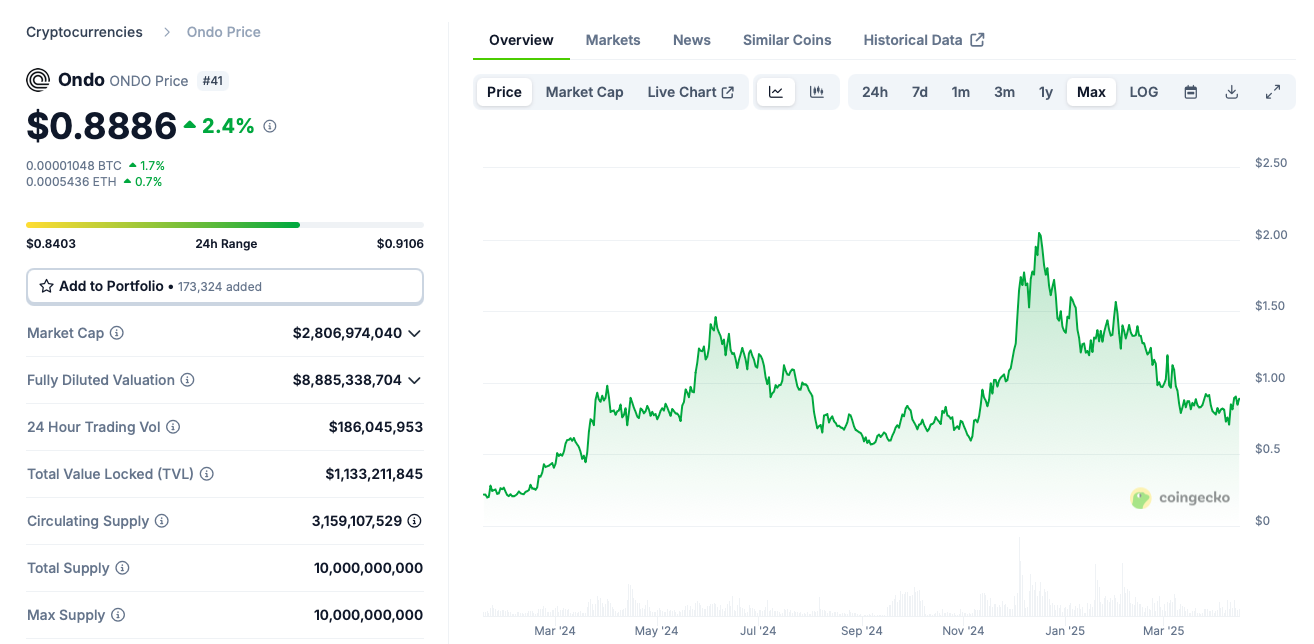

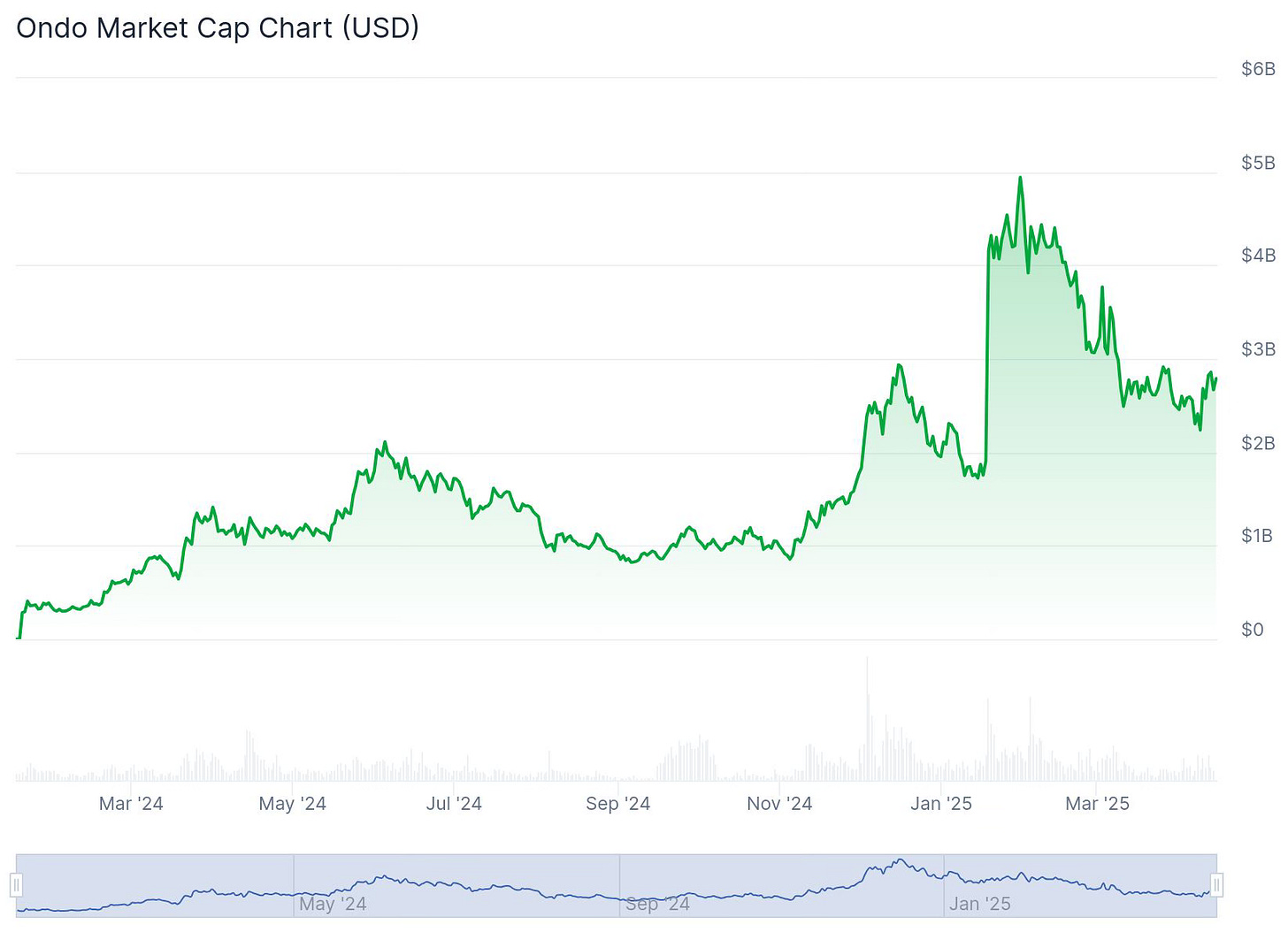

ONDO is currently trading at a $8.8bn valuation, with much of the supply held by insiders and team. With just over $1bn in TVL, they are earning around $50m a year in revenue to be generous.

Condom and others are claiming that ONDO is using the proceeds of its token sales to fund TVL for its protocol. With inflated token prices, they then can unlock borrowing markets and access relatively cheap cost of capital.

While the price of ONDO has stayed relatively flat since its launch, its seen massive token inflation taking its market cap from zero to a peak of $5bn in just over a year.

Will ONDO be the next big short? Let us know in the comments.

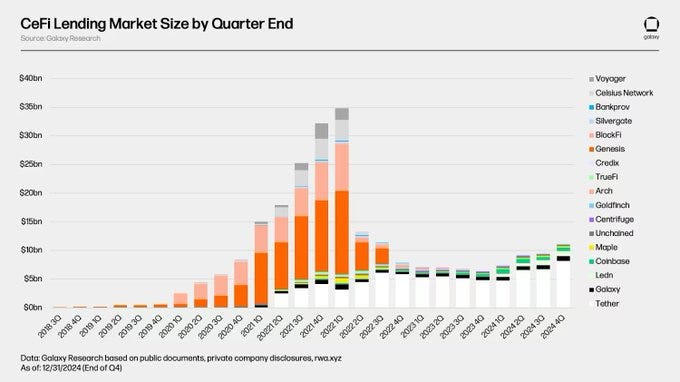

Speaking of Lending, the CEFI credit book has never really recovered after Genesis, BlockFi and Celsius collapsed.

Alex Thorn went back through the bankruptcy docs for the now debunk lenders and pieced together a great chart of the total loan book since 2018.

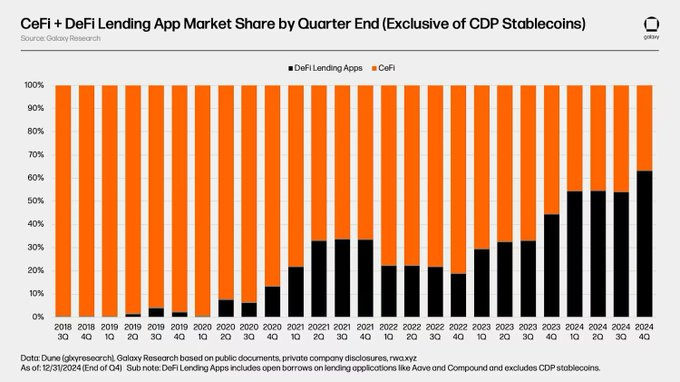

The most surprising chart is that DeFi lending now represents more than 50% of all outstanding loans in crypto. This is a huge win for our industry as Aave, Curve, and other lenders bring radical transaparency to their loan books.

AAVE, CRV, FRAX, DOLO all beneficiaries.

Speaking of CRV, its now above its 30 and 100 day EMA, signalling strength in these turbulent markets. With the stablecoin narrative taking over, a CRV resurgence might be on the cards for 2025.

It’s now 100% off the lows from last year and is trending higher while the rest of the market is suffering.

Share this post