The gov token for the fastest growing lending protocol for 2025 is now live.

Leviathan’s been following Dolomite for a long, long time now.

When they first popped onto our radar at Leviathan back in 2023, Dolomite was already turning heads. Their TVL was sub $10m and they were a scrappy DeFi lending platform on Arbitrum, one among dozens vying for attention.

But when we first spoke with Founder Corey Caplan, you could tell that this project was different. They had successfully carved out a corner of Arbitrum and were providing lending services Aave wouldn’t offer at the time.

Through the USDC depeg, the DAI scare, FTX, and wave after wave of liquidations, Dolomite stayed operational. No bad debt, no exploits, no missteps.

Now they are closing in on a billion, they’ve taken over Berachain, and are on their way to compete with Aave, Compound and Morpho. It’s one of the biggest launches of the year and you need a front-row seat.

$DOLO

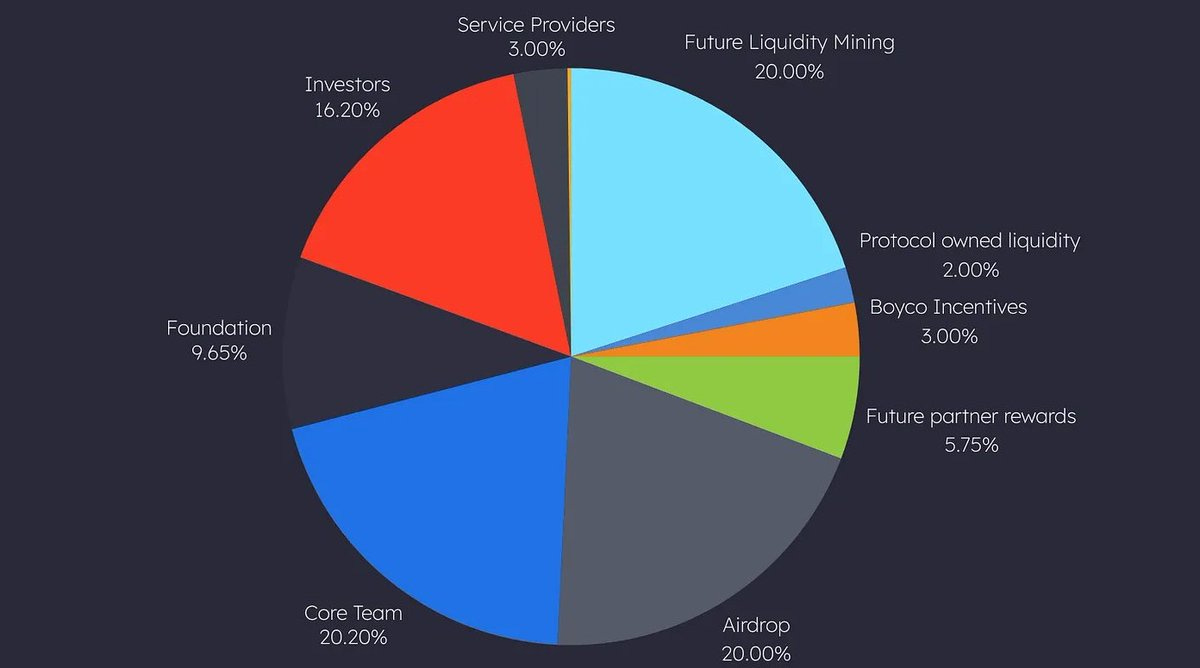

DOLO introduces a structure that splits responsibilities across three tokens, each with a focused role inside the ecosystem.

DOLO is the native token. It’s liquid and portable, with planned cross-chain compatibility through Chainlink’s CCIP. It underpins the liquidity layer of the system.

oDOLO is the liquidity incentive layer. You earn it by supplying assets to the protocol. It’s also a bonding token, which means users who want to participate in governance and protocol direction convert oDOLO into veDOLO.

veDOLO is the governance token. It gives users a seat at the table and, subject to DAO approval, access to a share of revenue from lending interest, trading fees, and protocol utilities. This structure keeps governance tied to users who have real exposure, not random airdrop hunters.

The whole system is built to encourage long-term alignment, reduce speculative churn, and reward the people who are actually using the protocol.

Features That Actually Do Something

Dolomite’s architecture is built for modular upgrades. Nothing is bolted on after the fact. Everything is native and tightly integrated.

Dynamic Collateral lets you borrow against assets while still staking, voting, or earning yield.

Zap compresses complex DeFi interactions into a few clicks, minting, trading, and strategy deployment all bundled into one.

Smart Debt opens up fee-sharing by letting other users swap your collateral or debt positions, unlocking new yield layers.

Strategies Hub offers one-click access to advanced yield farming setups.

E-Mode adjusts leverage automatically based on asset correlation.

Dolomite Actions (coming soon) will let you automate everything, limit orders, stop losses, rebalancing.

They’re also integrating directly with Berachain’s Proof of Liquidity, which gives users access to rewards and leverage strategies that were previously siloed.

Everything works together. Nothing’s there for show.

Why This Could Be the Next Breakout

Dolomite already has the fundamentals. $1B TVL. A real team with a long history. Core infra built in-house. They’ve survived every market test without outside help.

Now they’ve launched their token at a fraction of the valuation you’d expect from a top 10 protocol. That creates room to run.

We’re so proud to see the Dolomite team achieve this after years of putting the work in. They’ve earned it. Now go listen to the podcast with Corey and get $DOLO-pilled.

Share this post