Alright, we’ve got a lot to get into this week.

Markets are catching their breath, but beneath the surface there’s a ton of movement: buybacks kicking off, new chains launching, traders rotating into testnets and real-world assets. It’s a week where alpha is fractal — some small things, some big moves, all worth tracking.

There’s been a bunch of news in DeFi and crypto that we haven’t covered this week

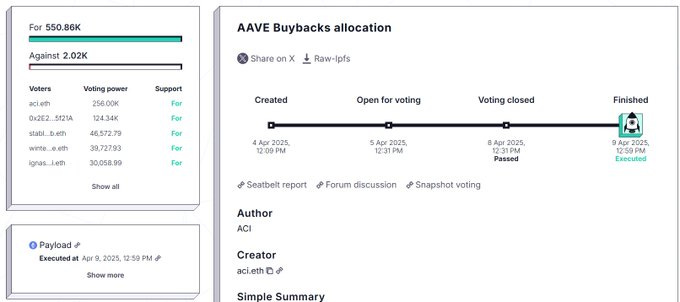

AAVE’s buybacks are live. Finally.

The Aave DAO just approved a $1m per week buyback using surplus revenue, aimed at reducing token supply and rewarding long-term stakers.

It’s set to run for six months, and the first buys already hit.

Buyback are one of the more contentious protocol operations in 2025, because we've seen from experience how teams can let their treasury be eaten away through dividends and other paid out expenses. It might be good for investors in the short term, but in the longer term, runway and dry powder for major capital expenses have shown to be critical for success.

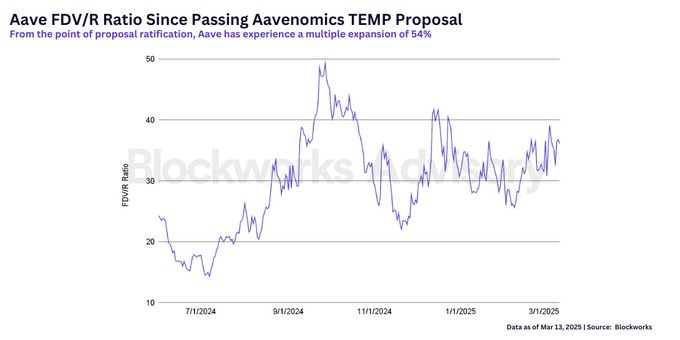

Blockworks Advisory made a good critique of Aave DAO's Aavenomics proposal, arguing that buybacks signal overconfidence in Aave's market dominance and may weaken its competitive position in the nascent DeFi lending sector.

In their report they highlighted Raydium's failed buyback program, which repurchased $175M in tokens at a 47% loss, suggesting Aave should instead reinvest its $115M treasury into becoming a lender of last resort to strengthen its moat.

They also noted that Aave's FDV/R ratio has risen to 54% since the proposal, indicating potential overvaluation risks, and warned that buybacks could make Aave "exit liquidity" for competitors, especially given the 8-month delay between proposal stages that telegraphed the repurchase plan.

Interestingly, due to macro conditions, AAVE is trading at YTD lows of $134.

On a longer timeframe, AAVE is trading only 150% above its recent ATH at $46.

Since launch Aave has collected $1.2bn in revenue and over $250m in fees. However, the recent price declines can be attributed to decreasing TVL and lowered rate expectations due to Trump’s trade wars.

We’re huge fans of Aave. They are the #1 DeFi protocol and have shown excellence and operational rigor for a half decade now.

If AAVE is not a part of your long term DeFi portfolio, it should be the first project your research this year.

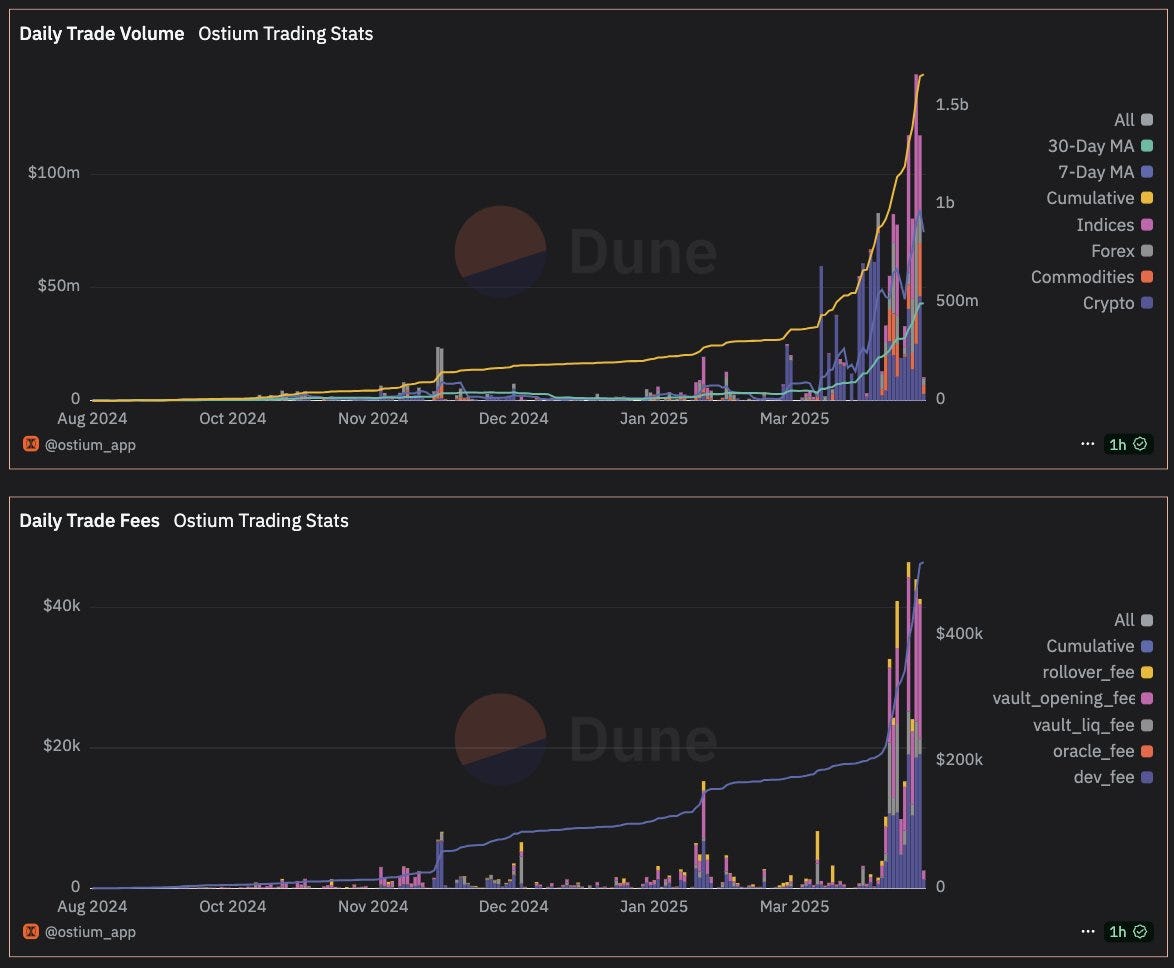

Ostium Labs goes exponential

One of our favorite up-and-coming protocols Ostium has been crushing it in the last month after the launch of their points system.

The protocol saw a 600% spike in wallet activity and over $1 billion in trading volume on their Arbitrum-based perpetual futures DEX.

The launch of a new points system, distributing 500k points weekly from a 10M pool to traders and liquidity providers, has been the core driver of the activity.

Since mid March they've been averaging close to $100 million a day of daily volume, and they hit an all-time high in volume this past week with $144 million in one day.

These two charts that were shared show a beautiful hockey stick of growth for the platform after launching back in October of last year.

Wayfinder’s $PROMPT TGE dropped… and dipped.

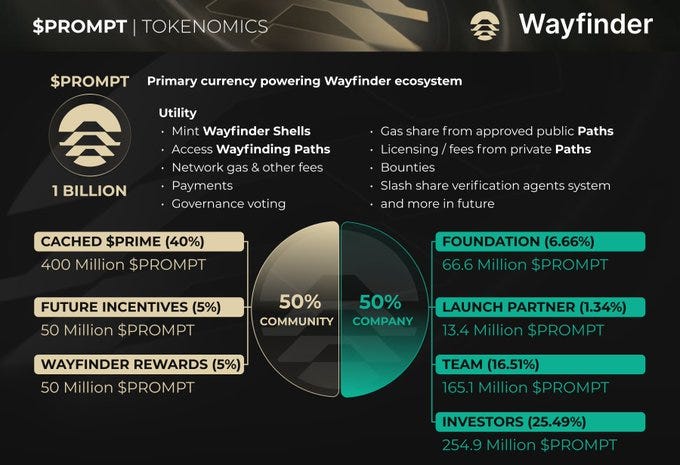

Wayfinder launched its $PROMPT token on April 9, 2025, after months of anticipation and a large-scale airdrop campaign.

Leviathan hasn’t covered Wayfinder before unfortunately. They just popped up on our feeds.

We have covered the parent team Parallel, who is building a sci-fi trading card game, and backed by the Echelon Prime Foundation. Wayfinder is going to be integrated into the game mechanics, with AI behavior modeling, and crypto incentives into a programmable agent economy.

Wayfinder’s agents will be able to trade, vote, farm airdrops, manage on-chain accounts, and coordinate with each other. The project was inspired by a 2023 Stanford paper on simulating AI “towns,” allowing agents to “think,” “remember,” and take action inside permissionless environments.

The $PROMPT token powers the ecosystem, used for agent execution, governance, and resource allocation within the protocol.

Leading up to the token generation event, more than 23 million PRIME tokens were staked, which accounted for over half of the circulating supply. In return, stakers received a 40 percent yield in $PROMPT.

The team allocated 40% of the total supply to the community, with 39% going to stakers and 1% to free signups. To incentivize adoption, Wayfinder offered an extra 5% bonus to users who claimed their tokens through an OKX Web3 wallet.

Trading officially opened on OKX on April 10 with the PROMPT/USDT pair, providing immediate liquidity and access.

The launch wasn’t without its issues.

A MEV bot exploit targeted the airdrop claims and successfully frontran transactions, siphoning off over $200,000 worth of ETH from unsuspecting users.

While the token’s price initially pulled back since its debut, its been ripping higher after the initial claim period. It’s currently trading at $0.37, a 3x from its listing price.

GMX Whale liquidated for $13m

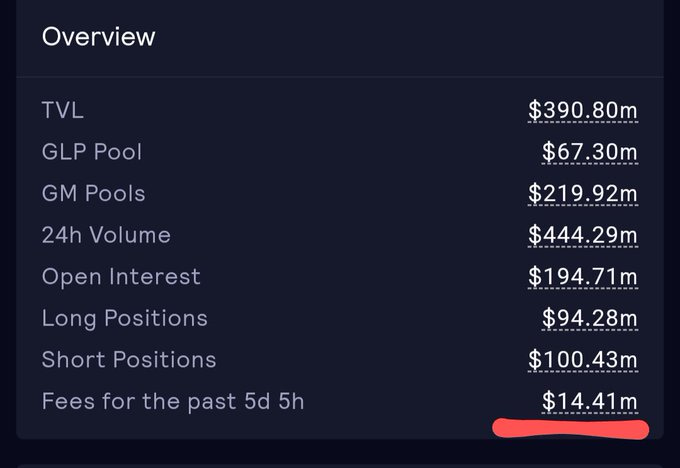

Arbitrum based perpetual trading platform GMX achieved its highest 1-day fee gain after a massive whale was liquidated on AVAX for $13m worth of collateral. The trader had opened a massive long position last year and finally was liquidated this past week when Bitcoin prices dropped to $76k.

The protocol will use 30% of the fees to buyback GMX and the remaining $10m will be shared with the lucky depositors in the GLP vault.

Share this post