Volatility continues as markets are whipsawed on news of Trump's tariffs.

Ok, lets talk about the last 96 hours, because its been wild in the market. While everyone has been talking about tariffs the real drama has been much, much deeper.

So picture this: it’s 10:15 AM Eastern on April 7th (3 days ago).

A rumor drops that Trump is pausing all tariffs for 90 days, except for China.

We reported about this on Monday, how Deltaone reported the info, and then the White House later denied it.

But in the moment, the S&P 500 rockets up over 400 points, reversing heavy losses from earlier in the day. If the news had been true, we’d be calling it the relief rally.

But even as the equity markets were ripping, something way more ominous was unfolding.

The 10-year Treasury yield spiked over 30 basis points in one of the sharpest intraday reversals in recent memory. Bonds and stocks typically trade inversely correlated. When stocks go up, bonds go down. So when both are going up, that’s not how they should behave when good news hits.

TLT, the long-duration Treasury ETF, saw its *highest* trading volume ever, 25% above previous records. Traders were selling 10y’s and other long dated duration en masse.

Rate cut expectations for May collapsed.

We went from 85% odds of a cut… to 33%. In one session.

And it wasn’t just US markets. Japan’s 20-year yield spiked, the Nikkei jumped 6%, DAT load volumes surged, even as consumer credit numbers in the U.S. came in shockingly low.

The bond market broke.

You need to understand that the bond market is a much bigger beast than US equity markets. Any breakdown in bonds causes widespread issues at financial institutions on a far greater scale.

So when you have these wild swings in bonds, it doesn’t say “hooray, tariffs are paused.” It says “something is breaking.”

We know now that the tariff rumor was most likely true at that time. For some reason the Trump admin didn’t want to announce it just then, but some staffers and other advisors must have known that Trump was planning a 90 day pause.

Then comes April 9.

First, Trump told his people on Truth Social that it was a “great time to buy.”

Trump makes the actual announcement: most tariffs lowered to 10%, but China’s go up to 125%. Again, markets rip. The NASDAQ jumps almost 10%.

Surprisingly, call volume (bullish bets) spiked an hour before Trump’s announcement. Was this insider trading or was it just the market sniffing out the future announcement.

But here’s the issue, while Trump’s buddies were buying the dip, bonds are telling a different story.

Yields went higher, gold jumps $100 in one day, junk bond yields hit 8.5%, a 52-week high. SOFR swap spreads collapse. Crude oil tanks. And again, TLT gets hammered.

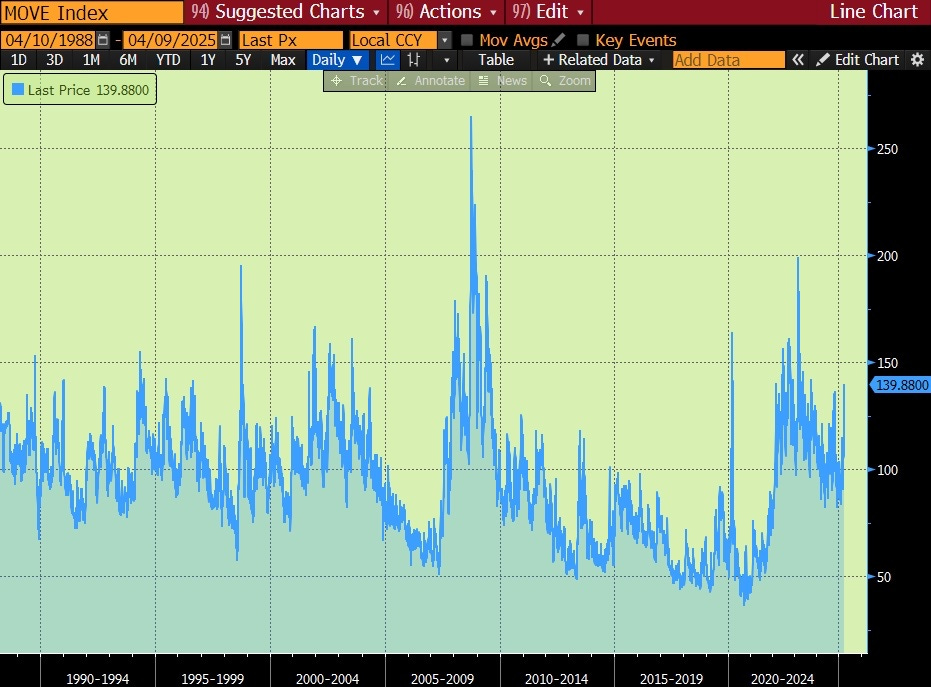

The MOVE index, which is the VIX aka fear index for bonds, jumped to 178, levels not seen since the Covid crash and before that the 2008 financial crisis.

This is not a healthy market. Especially one in a “relief rally.”

Knowing what we do now, did the Trump team float the 90 day pause rumor to give the Fed, Treasury, global central banks and hedge funds time to adjust their positions and avoid blowing up?

When the actual announcement came out the bond market reacted poorly, even though stocks were ripping. The bond market always can sniff out danger first.

So what do we watch for next?

It’s though that Trump paused all of the tariffs due to Japan, the largest foreign holder of U.S. debt at $1.1 trillion , unexpectedly led the debt sell-off, not China, causing global market turmoil. Japan’s Nikkei fell 4% and Taiwan’s index dropped 5.8%. Japan was most likely selling treasuries to prop up their financial institutions from the massive volatility.

If Trump keeps up this level of volatility in the markets for an extended period of time, someone somewhere is going to blow up in spectacular fashion. We're probably going to see news in the next few days about hedge funds which got caught off guard and are facing billions in losses.

At some point, the financial player will become so big that the fed or other central banks will have to intervene to “save financial markets,” which is really just a bail out for overleveraged hedge funds and banks.

And when that happens, the Fed will flood the market with liquidity, bond rates will drop, the USD will devalue.

Guess what happens next… 🚀 BTC

SEC approves options trading on Spot ETH ETFs

SEC gives crypto a win yesterday and will have huge implications for Ethereum. The SEC has officially approved a rule change allowing options to be listed and traded on the iShares Ethereum Trust, ticker ETHA.

Back in July 2024, Nasdaq ISE proposed this rule change to list options on ETHA. It went through the usual SEC process, comment periods, data requests, back and forth, and by March 2025, ISE had filed an updated version with a ton of detailed analysis to back it up.

That’s what the SEC just approved.

The new options products will be physically settled, American-style options on the iShares Ethereum Trust.

One big constraint for the ETH options will be position and exercise limits will be capped at 25,000 contracts per side. This is the lowest limit for any regulated US options product in the entire market.

The SEC likely sees the risk posed by ETH as a highly volatile crypto asset and is worried about potential market manipulation. We would guess that the SEC is going to wait and see what happens with the options market as it trades over the next months.

Options unlock a whole new dimension of market structure. TradFi players can now use these products to reduce volatility, hedge, get leveraged exposure and allow for greater institutional flows. And from a macro perspective, it brings Ethereum one step closer to becoming a core part of the traditional financial system.

Big win, Big news.

Bitcoin life insurance firm Meanwhile raises $40m

Meanwhile, a life insurance company... denominated in bitcoin... just raised $40 million in a Series A.

Framework Ventures and Fulgur Ventures co-led the round, and one of the notable backers was Wences Casares, founder of Xapo Bank and Bitcoin OG.

They’re building what they call a “BTC Whole Life” insurance product.

The whole thing, premiums, payouts, and even policy-backed loans are denominated in BTC. That means if you’re buying into one of these policies, you’re betting that bitcoin will hold or gain value over your lifetime. And if you bet right, you’ll your eventual payout will grow with it.

This is the second raise for Meanwhile, as they originally raised $19 back in 2023 to get regulatory approval from the Bermuda Monetary Authority. Open AI CEO Sam Altman took was one of the people who took part in that round.

Now with this new $40 million Series A, they’re planning to scale operations and expand the product. They’re also eyeing a $100 million BTC-denominated private credit fund, designed to generate a 5% bitcoin yield by lending BTC out to institutional borrowers.

So, why bitcoin life insurance?

It’s all about preserving purchasing power in a world of currency debasement, according to Meanwhile CEO Zac Townsend.

Bitcoin is argued as a potential hedge against fiat inflation, even in the U.S., where the dollar’s lost about 25% of its value over the past five years. Meanwhile’s life insurance product is a way to hold and grow BTC in a tax-advantaged, long-term structure.

And unlike Saylor who is taking his Bitcoin to his grave, when and if you die, your policy gets paid out to your next of kin.

Share this post